Welcome

This documentation was last updated on Wed Mar 13 08:31:05 UTC 2024 and covers Mambu Version v9.158.1

Welcome to the Mambu API v2 documentation. Here you can learn everything you need to know about API v2 and how to interact with Mambu!

We offer language bindings in cURL, HTTP, JavaScript, Node.js, Ruby, Python, Java, and Go. You can view code examples in the dark area to the right, and you can switch the programming language of the examples with the tabs at the top right.

You can also download OpenAPI specifications for all of our endpoints which can be used to generate client SDKs, interactive documentation, create mock servers and more. For more information, see the OpenAPI specification section.

About Mambu API v2

Scroll down for code samples, example requests, and responses. Select a language for code samples from the tabs above or the mobile navigation menu.

Mambu API v2 is a fully compliant RESTful API and we recommend building all new integrations with API v2 (instead of API v1).

Base URLs

The base URL for requests to the API is:

https://TENANT_NAME.mambu.com/api

To make requests to your tenant's sandbox, use the following base URL:

https://TENANT_NAME.sandbox.mambu.com/api

For more information, see the Sandbox section.

HTTP Verbs

Standard HTTP verbs are used to indicate the API request method.

| Verb | Function |

|---|---|

GET |

To retrieve a resource or a collection of resources |

POST |

To create a resource |

PATCH |

To modify an existing resource |

PUT |

To replace an existing resource |

DELETE |

To delete a resource |

Authentication

Mambu supports two methods for authenticating API requests:

- Basic authentication, using Mambu UI login credentials for a user account with API access permissions.

- API keys, which are unique UUID tokens provided in an

apiKeyheader (Early Access feature).

Basic Authentication

curl --location --request GET 'https://TENANT_NAME.mambu.com/api/users' \

--header 'Authorization: Basic U29tZVVzZXI6T3BlblNlc2FtZQ=='

GET /api/users HTTP/1.1

Host: TENANT_NAME.mambu.com

Authorization: Basic U29tZVVzZXI6T3BlblNlc2FtZQ==

var settings = {

"url": "https://TENANT_NAME.mambu.com/api/users",

"method": "GET",

"timeout": 0,

"headers": {

"Authorization": "Basic U29tZVVzZXI6T3BlblNlc2FtZQ=="

},

};

$.ajax(settings).done(function (response) {

console.log(response);

});

require "uri"

require "net/http"

url = URI("https://TENANT_NAME.mambu.com/api/users")

https = Net::HTTP.new(url.host, url.port)

https.use_ssl = true

request = Net::HTTP::Get.new(url)

request["Authorization"] = "Basic U29tZVVzZXI6T3BlblNlc2FtZQ=="

response = https.request(request)

puts response.read_body

import requests

url = "https://TENANT_NAME.mambu.com/api/users"

payload={}

headers = {

'Authorization': 'Basic U29tZVVzZXI6T3BlblNlc2FtZQ=='

}

response = requests.request("GET", url, headers=headers, data=payload)

print(response.text)

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

Request request = new Request.Builder()

.url("https://TENANT_NAME.mambu.com/api/users")

.method("GET", null)

.addHeader("Authorization", "Basic U29tZVVzZXI6T3BlblNlc2FtZQ==")

.build();

Response response = client.newCall(request).execute();

package main

import (

"fmt"

"net/http"

"io/ioutil"

)

func main() {

url := "https://TENANT_NAME.mambu.com/api/users"

method := "GET"

client := &http.Client {

}

req, err := http.NewRequest(method, url, nil)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Authorization", "Basic U29tZVVzZXI6T3BlblNlc2FtZQ==")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

For basic authorization, provide your username and password directly via the Authorization header in the format Basic {base64-encoded-string}, where base64-encoded-string is the base-64-encoded value of your username and password separated by a colon ':'.

For example, a user with the username SomeUser and the password OpenSesame would take the value SomeUser:OpenSesame and base-64 encode it, yielding U29tZVVzZXI6T3BlblNlc2FtZQ==. They would then provide an Authorization header for their request with the value Basic U29tZVVzZXI6T3BlblNlc2FtZQ==.

See the code samples for this section for sample GET requests to the /users endpoint using the above example.

Note that the login credentials must be for a user account with API access permissions. For more information, see Creating a User - Access Rights in our User Guide.

API Keys

API keys are tokens that you provide in an apiKey header to authenticate requests. They are generated by API consumers, which are an abstraction similar to an OAuth client.

API consumers are currently an Early Access feature. If you would like to request access to this feature, please get in touch with your Mambu Customer Success Manager to discuss your requirements.

For more information on API consumers and keys, see API Consumers in our User Guide.

Versioning

# You can also use wget

curl -X {HTTP Verb} https://TENANT_NAME.mambu.com/api/{Insert resource URI here} \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'TENANT_NAME.mambu.com/api/{Insert resource URI here}',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Mambu API v2 provides a versioning system to assist with backwards compatibility. Contract changes will result in a new version of each affected resource becoming available without the old version immediately becoming obsolete.

Versioning is supported in API requests via the Accept header.

Template: application/vnd.mambu.{version}+json

To retrieve a specific version of an entity, fill a value into the template above.

The highest currently supported version is v2.

Payloads

Mambu API v2 currently has endpoints that accept and return either application/json, application/yaml, or multipart/form-data payloads.

When making a POST, PUT, or PATCH request, you must use the Content-Type header to specify the content type of the payload.

Requests

Code samples

# You can also use wget

curl -X {HTTP Verb} https://TENANT_NAME.mambu.com/api/{Insert resource URI here} \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

API requests (also known as API calls) to the Mambu API identify who the requester is and exactly what information they wish to retrieve or which action they wish to perform.

To put together an API request you will need to combine:

- The HTTP verb

- The full URI to the resource

- HTTP headers, for example, headers for authentication, versioning, and payload content types

- The payload (if required)

Responses

Error Response

{

"errorCode":"4",

"errorSource":"Property scheduleSettings.repaymentInstallments may not be null",

"errorReason":"INVALID_PARAMETERS"

}

The response to a request will contain either an error response or a payload in the content type that the endpoint accepts.

Error response

An error response will consist of:

| Field | Type | Availability | Content |

|---|---|---|---|

errorCode |

number | Always present | A unique error code. For more information, see API Responses and Error Codes. |

errorSource |

string | Sometimes present | A human-readable message capturing unsatisfied constraints. |

errorReason |

string | Always present | A human-readable message stating the general category of the failure. |

Idempotency

Code samples

# You can also use wget

curl -X POST https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions \

-H 'Content-Type: application/json' \

-H 'Accept: application/vnd.mambu.v2+json' \

-H 'Idempotency-Key: 01234567-9abc-def0-1234-56789abcdef0'

POST https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions HTTP/1.1

Host: TENANT_NAME.mambu.com

Content-Type: application/json

Accept: application/vnd.mambu.v2+json

Idempotency-Key: 01234567-9abc-def0-1234-56789abcdef0

var headers = {

'Content-Type':'application/json',

'Accept':'application/vnd.mambu.v2+json',

'Idempotency-Key':'01234567-9abc-def0-1234-56789abcdef0'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions',

method: 'post',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Content-Type' => 'application/json',

'Accept' => 'application/vnd.mambu.v2+json',

'Idempotency-Key' => '01234567-9abc-def0-1234-56789abcdef0'

}

result = RestClient.post 'https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/vnd.mambu.v2+json',

'Idempotency-Key': '01234567-9abc-def0-1234-56789abcdef0'

}

r = requests.post('https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

String idempotentKey = UUID.randomUUID().toString();

con.setRequestProperty(“Idempotency-Key”, idempotentKey);

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Content-Type": []string{"application/json"},

"Accept": []string{"application/vnd.mambu.v2+json"},

"Idempotency-Key": []string{"01234567-9abc-def0-1234-56789abcdef0"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("POST", "https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Idempotent requests to the Mambu API are guaranteed to be executed no more than once.

Working with financial transactions, it is important to ensure some requests are not repeated for any reason, which may result in data loss or accidental duplication. You may configure requests to be idempotent by providing an Idempotency-Key header and providing a unique UUID token for the request. This will guard against the possibility of error if a request must be retried.

When an idempotent request is processed, the status code and body of the response is associated with the idempotency key and stored in a cache. If the request is duplicated for any reason, the duplicate request will not be processed, and the response will be re-sent to the client.

Idempotent requests that fail at the server level such validation failures are not stored in the cache. Subsequent requests with the same idempotency key will be processed as if they were new, receiving the same 400 BAD REQUEST status code.

For examples of idempotent requests, see the code samples for this section.

Idempotency Keys and Retry Mechanisms

Idempotency keys must use the v4 UUID format (32 hexadecimal digits, in a 8-4-4-4-12 arrangement, such as 01234567-9abc-def0-1234-56789abcdef0).

We recommend generating UUIDs programmatically or by using an online generator such as UUID Generator to ensure that all keys are valid V4 UUIDs.

Retry mechanisms must:

- Use the same key for initial calls and retries.

- Retry at a reasonable frequency so as not to overload the API.

- Properly identify and handle error codes.

Sandbox

The sandbox tenant (also known as sandbox environment) is independent from the production tenant, and any changes you make in the sandbox will not affect the data in your production tenant. For more information, see Sandbox in our User Guide.

To make requests to your tenant's sandbox, use the following base URL:

https://TENANT_NAME.sandbox.mambu.com/api/

The sandbox is generally one version ahead of the production tenant. As such, it may include changes that are currently in, or may soon be in, the production environment. For more information, see Mambu Release Cycle.

Sandbox management

To manage your sandbox go to the Customer Service Portal. For more information and instructions, see Customer Service Portal - Sandbox Management.

Pagination

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here?offset=10&limit=10&paginationDetails=ON HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Response headers

(...)

content-type: application/vnd.mambu.v2+json

date: Mon, 03 Sep 2018 10:56:15 GMT

items-limit: 10

items-offset: 10

items-total: 35

(...)

Mambu API v2 has customisable pagination capabilities which can be used with all GET requests. It also has sorting and filtering capabilities for search endpoints.

We strongly recommend using the pagination, sorting, and filtering capabilities when making requests which will return a large number of records because response times are much faster.

Pagination query parameters

Pagination is deactivated by default and must be specified in each request. There are three available query parameters you may use, paginationDetails, offset, and limit.

paginationDetails

The paginationDetails query parameter returns pagination details in the header of your response. The default value is OFF. To include pagination details set the value to ON. Pagination details includes the total number of records, the limit value, and the offset value.

limit

The limit query parameter determines the number of records that will be retrieved. The default value is 50. The maximum value is 1,000.

offset

The offset query parameter determines how many records will be skipped before being included in the returned results. The default value is 0.

In the example, we can see that there are 35 total records. By setting offset to 10 and limit to 10, we are returning the second set of 10 records, essentially "Page 2" of our paginated response.

Pagination best practices

Once you have used the pagination query parameters to retrieve all the available records in the database for your specific query, you no longer need to make any additional API requests.

To determine whether you need to make any additional API requests you may compare the value of the limit parameter to the number of records retrieved in the body of your request.

If the number of records is less than the value of the limit parameter then no additional API requests are necessary.

If the number of records is equal to the limit value then you may make additional API requests.

If you receive an empty array [] in the body of your request, this means there are no records for that request and you do not need to make any additional API requests.

Sorting and filtering with search endpoints

All the search endpoints in API v2 end in :search. Search endpoints accept a filterCriteria array of objects and a sortingCriteria object in their request body.

When making broad searches that will return a lot of records, using pagination with appropriate values can ensure that your result set will not shift as new records matching your search criteria are created, which may otherwise lead to duplicates across pages.

sortingCriteria

The sortingCriteria object has two properties, field and order.

field property

We recommend you enter either an incremental ID or a timestamp as the value for the field property.

order property

The order property accepts two values, ascending (ASC) or descending (DESC). The default value is DESC, however, if using pagination or a search where new records are being actively created, for example transactions or journal entries created up to and including the current day, we strongly recommend you set the value to ASC. This will cause new records to be added to the end of your result set.

filterCriteria

If you are making a broad search that will return a lot of results, we recommend constraining your search query using a time interval. This may be done by setting the field property to a date property such as creationDate or valueDate. Setting the operator property to BETWEEN. And entering two dates as the values for the value and secondValue properties. This will ensure that no newly created records will interfere with a set of results. Please see the related note about searches using the BETWEEN operator in the considerations for specific field types section below for more information about this operator.

Details Level

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here?detailsLevel=FULL HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Mambu API v2 supports two details levels for responses:

-

BASIC-- By default, API v2 will return theBASIClevel of detail. This includes all first level elements of an object. -

FULL-- This details level includes everything fromBASICas well as all custom field values, any address or contact information, and any other related objects.

To view a higher level of detail, include detailsLevel as a query parameter in your request and give it the value FULL.

Audit Trail and the User-Agent Header

Error when User Agent header is not provided

{

"errors": [

{

"errorCode": 4,

"errorSource": "The user agent cannot be null when the Audit Trail feature is enabled",

"errorReason": "INVALID_PARAMETERS"

}

]

}

Audit trail tracks all activities performed in the Mambu Core Banking system via the UI or API v1 and v2. For more information, see Audit Trail in our User Guide.

When the audit trail feature is enabled, you must provide a User-Agent header for all requests to any endpoint, or the request will fail with the error message The user agent cannot be null when the Audit Trail feature is enabled.

Note that if you are using a REST client like Postman or Curl, this header is probably provided automatically. However, if you generate a request to the API, you must provide it yourself.

The User-Agent header provides information regarding the browser and operating system (such as the browser version), and information about the library or tool issuing the request (such as the client Java version). It is generally used to assist with debugging problems.

OpenAPI Specification

This API Reference documentation is automatically generated from OpenAPI Specification (OAS) files.

We allow you to:

- Retrieve a list of all available APIs.

- Retrieve an OAS file in either a basic format (without custom field values) or an enriched format (with custom field values).

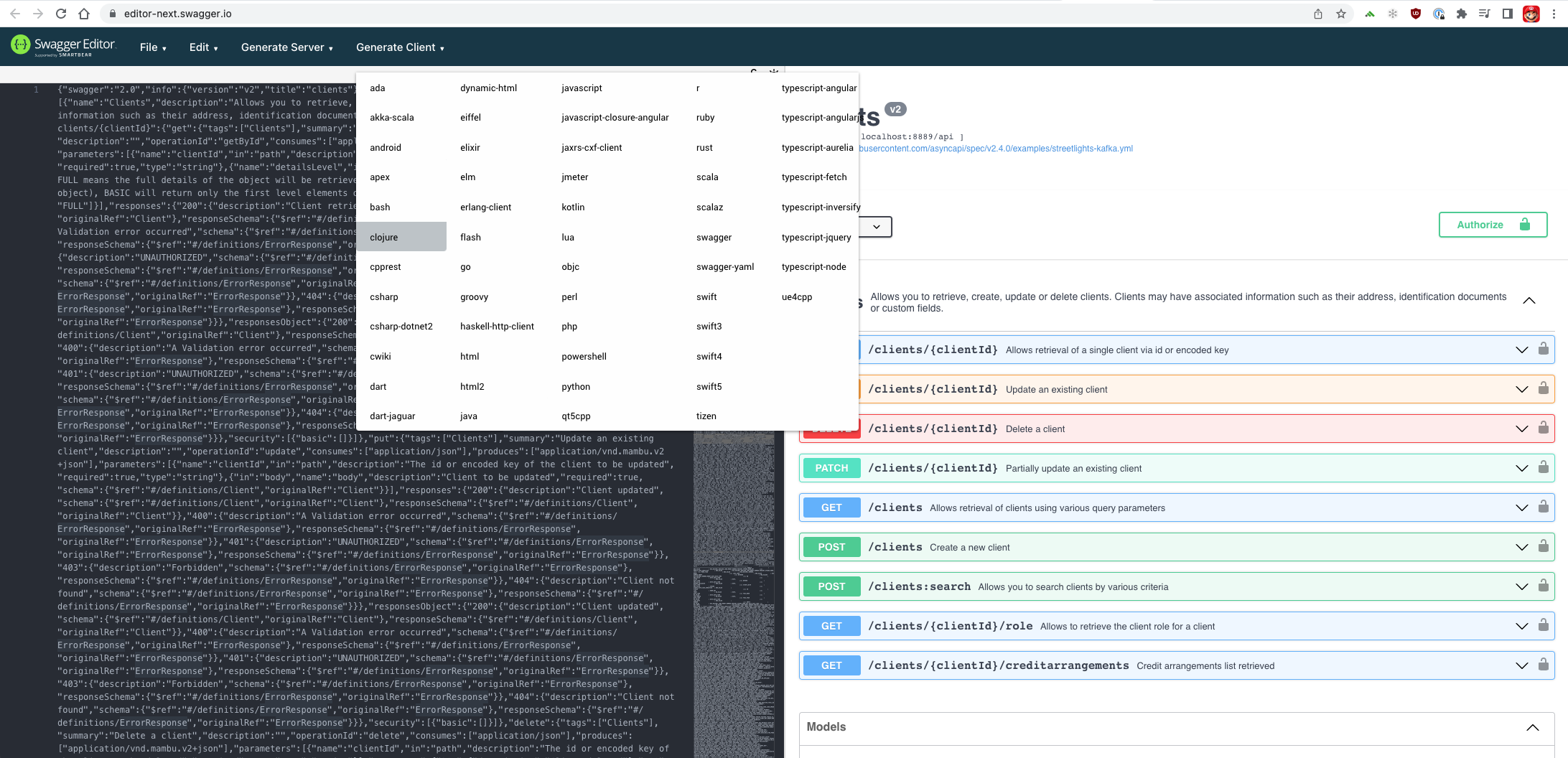

You can use the JSON-formatted OAS files to scaffold client SDKs in various languages. See Generating SDKs from OAS below.

API discovery

Request samples

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/swagger/resources \

-H 'apikey: APIKEY'

GET https://TENANT_NAME.mambu.com/api/swagger/resources HTTP/1.1

Host: TENANT_NAME.mambu.com

apikey: APIKEY

var headers = {

'apikey':'APIKEY'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/swagger/resources',

method: 'GET',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'apikey' => 'APIKEY'

}

result = RestClient.get 'https://TENANT_NAME.mambu.com/api/swagger/resources',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'apikey': 'APIKEY'

}

r = requests.get('https://TENANT_NAME.mambu.com/api/swagger/resources', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/swagger/resources");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty("apikey", "APIKEY");

con.setRequestMethod("GET");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"apikey": []string{"APIKEY"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("GET", "https://TENANT_NAME.mambu.com/api/swagger/resources", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Example response

{

"items": [

{

"jsonPath": "json/clients_v2_swagger.json",

"label": "Clients",

"hashValue": "Clients",

"index": 0

},

{

"jsonPath": "json/clients_documents_v2_swagger.json",

"label": "Client Documents",

"hashValue": "Client_Documents",

"index": 1

},

{

"jsonPath": "json/branches_v2_swagger.json",

"label": "Branches",

"hashValue": "Branches",

"index": 2

},

{

"jsonPath": "json/centres_v2_swagger.json",

"label": "Centres",

"hashValue": "Centres",

"index": 3

},

...

{

"jsonPath": "json/configuration_iddocumenttemplates.yaml_v2_swagger.json",

"label": "Identification Document Templates Configuration",

"hashValue": "Identification_Document_Templates_Configuration",

"index": 64

},

{

"jsonPath": "json/configuration_loanrisklevels.yaml_v2_swagger.json",

"label": "Loan Risk Levels Configuration",

"hashValue": "Loan_Risk_Levels_Configuration",

"index": 65

},

{

"jsonPath": "json/currencies_v2_swagger.json",

"label": "Currencies",

"hashValue": "Currencies",

"index": 66

}

]

}

To retrieve either the basic OAS file or the enriched OAS file with custom field values for a specific API, you must first build the path for the resource.

To build the path for a resource you must retrieve the jsonPath value. This value is provided when you retrieve the list of all available APIs.

To retrieve the list of all available APIs you may use the https://TENANT_NAME.mambu.com/api/swagger/resources endpoint.

The response returns an array of objects. Each object represents an API and includes its jsonPath value.

Next, to retrieve the OAS file for a specific API. See Retrieving OAS Files below.

Retrieving OAS Files

Code Samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file} \

-H 'apikey: APIKEY'

GET https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file} HTTP/1.1

Host: TENANT_NAME.mambu.com

apikey: APIKEY

var headers = {

'apikey':'APIKEY'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}',

method: 'GET',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'apikey' => 'APIKEY'

}

result = RestClient.get 'https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'apikey': 'APIKEY'

}

r = requests.get('https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty("apikey", "APIKEY");

con.setRequestMethod("GET");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"apikey": []string{"APIKEY"}

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("GET", "https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Example response

{

"swagger": "2.0",

"info": {

"version": "v2",

"title": "clients"

},

"host": "localhost:8889",

"basePath": "/api",

"tags": [

{

"name": "Clients",

"description": "Allows you to retrieve, create, update, or delete clients. Clients may have associated information such as their address, identification documents, or custom field values."

}

],

"schemes": [

"http",

"https"

],

"paths": {

...

},

"securityDefinitions": {

"basic": {

"description": "",

"type": "basic"

}

},

"definitions": {

...

}

}

Once you have followed the steps to retrieve the jsonPath value for a specific API, you can build the path to a specific resource.

To retrieve the specification file for a given API, join the base URL with the value of the relevant jsonPath.

Basic OAS file

The basic OAS file will not include any custom field values and you do not need to authenticate to access this endpoint.

The endpoint to retrieve the basic OAS file is:

https://TENANT_NAME.mambu.com/api/swagger/{jsonPath}

For example, to retrieve the basic OAS file for the Clients API you would use:

https://TENANT_NAME.mambu.com/api/swagger/json/clients_v2_swagger.json

Enriched OAS file

The enriched OAS file will include any custom field values you have set up for your organisation at the time of generation. This endpoint requires authentication using either HTTP Basic Auth or an API key provided in an apikey header.

The endpoint to retrieve the enriched OAS file with custom field values is:

https://TENANT_NAME.mambu.com/api/swagger/complete{jsonPath}

For example, to retrieve the enriched OAS file for the Clients API you would use:

https://TENANT_NAME.mambu.com/api/swagger/completejson/clients_v2_swagger.json

Both endpoints are available for both your production and sandbox environments. Replace TENANT_NAME with TENANT_NAME.sandbox to access API specifications for the sandbox environment, which is usually one version ahead of production. This gives you time to investigate new features and functionality before using it in production.

Generating SDKs from OAS

Once you have your OAS file you are free to use any number of tools to generate a client SDK in your preferred language, for example, the freely available and online Swagger Editor. By either importing the file or copying the specification into the editor window you will be able to see both navigable documentation and the option located at the top of the window to Generate Client.

Remember to edit the host field in your OAS file to reflect your Mambu domain before generating your SDK. For more information on your Mambu domain, see Base URLs.

Searching for Records

A basic search query for loans from a particular product type, sort by approval date

POST /loans:search

{

"filterCriteria": [

{

"field": "loanName",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "Agriculture Loan"

}

],

"sortingCriteria": {

"field": "approvedDate",

"order": "DESC"

}

}

A search for current accounts which are active and overdrawn from two different branches using compound filters, sort by overdraft balance

POST /deposits:search

{

"filterCriteria": [

{

"field": "accountState",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "ACTIVE"

},

{

"field": "accountType",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "CURRENT_ACCOUNT"

},

{

"field": "balances.overdraftAmount",

"operator": "MORE_THAN",

"value": 0

},

{

"field": "assignedBranchKey",

"operator": "in",

"values": [

"8a193c26722b51b701722d779e7122de",

"8a193c26722b51b701722d779e7122df"

]

}

],

"sortingCriteria": {

"field": "balances.overdraftAmount",

"order": "DESC"

}

}

Search functionality is provided for a number of entities through dedicated endpoints that can be identified by the :search suffix, for example to search for deposit accounts you can use the /deposits:search endpoint. Search endpoints accept a POST request that can include an object containing a filterCriteria array of objects and a sortingCriteria object in the request body.

The filterCriteria array of objects allows you to narrow your search using multiple fields to filter by. Every entity that supports search has a schema that provides the enumerated values available for the filter properties, for example, the schema for a deposit account search is DepositAccountFilterCriteria.

The sortingCriteria object allows you to specify according to which field and in what way you would like to sort the returned results. Every entity that supports search provides a schema with all the available fields you can sort by. For example, the schema for sorting the results of a deposit account search is DepositAccountSortingCriteria.

Apart from native fields that are enumerated in the relevant schemas that you can use in your filter criteria, you can also filter by custom fields. For more information, see Searching by custom fields.

API v2 also provides a couple of additional features that allow you to further customize and manage your search queries.

The pagination query parameters allow you to break up your search into smaller chunks, for more information, see Pagination and Optimising Searches.

The detailsLevel query parameter allows you to specify the level of detail to include in the results. For more information, see Details Level and Optimising Searches.

Searching by custom fields

Search for entries where the given custom field definition has the value

FALSE

{

"filterCriteria": [

{

"field": "_marketing_opt_in.investor_newsletter",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "FALSE"

}

]

}

Search for entries where the given custom field definition has one of the given values, sort by ID

{

"filterCriteria": [

{

"field": "_group_details.industry",

"operator": "IN",

"values": [

"agriculture",

"arboriculture"

]

}

],

"sortingCriteria": {

"field": "id",

"order": "ASC"

}

}

You can build your filter and search queries using the native fields enumerated in the relevant schemas, for more information, see Searching for Records. However, you can also use custom field definitions and their values in your filter and search queries for any entities that support custom field definitions. For more information, see Custom Fields in our User Guide.

To filter or sort using a custom field definition you must provide the custom field set ID and the custom field definition ID using dot nation, for example _custom_field_set_ID.custom_field_ID. You can see an example of the syntax to the right. The custom field set can belong to the same entity or to a parent entity.

Filter Operators

Equals

{

"field": "overdraftSettings.allowOverdraft",

"operator": "EQUALS",

"value": true

}

Equals (case sensitive)

{

"field": "name",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "Daily Savings"

}

More than

{

"field": "balances.totalBalance",

"operator": "MORE_THAN",

"value": 500000.50

}

Less than

{

"field": "accruedAmounts.interestAccrued",

"operator": "LESS_THAN",

"value": 10000.10

}

Between

{

"field": "balances.feesDue",

"operator": "BETWEEN",

"value": 100,

"secondValue" : 500

}

On

{

"field": "approvedDate",

"operator": "ON",

"value": "2021-06-15"

}

After

{

"field": "lastModifiedDate",

"operator": "AFTER",

"value": "2022-04-20"

}

Before

{

"field": "creationDate",

"operator": "BEFORE",

"value": "2021-12-25"

}

Before inclusive

{

"field": "creationDate",

"operator": "BEFORE_INCLUSIVE",

"value": "2020-06-15"

}

Starts with

{

"field": "id",

"operator": "STARTS_WITH",

"value":"eban"

}

Starts with (case sensitive)

{

"field": "id",

"operator": "STARTS_WITH",

"value":"EBAN"

}

In

{

"field": "accountType",

"operator": "IN",

"values":[

"REGULAR_SAVINGS",

"CURRENT_ACCOUNT"

]

}

Today

{

"field": "approvedDate",

"operator": "TODAY"

}

This week

{

"field": "disbursementDetails.expectedDisbursementDate",

"operator": "THIS_WEEK"

}

This month

{

"field": "lastPaymentDate",

"operator": "THIS_MONTH"

}

This year

{

"field": "expectedMaturityDate",

"operator": "THIS_YEAR"

}

Last x days

{

"field": "firstRepaymentDate",

"operator": "LAST_DAYS",

"value": 12

}

Empty

{

"field": "overdraftRiskLevelKey",

"operator": "EMPTY"

}

Not empty

{

"field": "lastSetToArrearsDate",

"operator": "NOT_EMPTY"

}

The table below contains available operators as well as the types of field they are compatible with and the number of values they support.

| Operator | Affected values | Available for |

|---|---|---|

| EQUALS | ONE_VALUE | BIG_DECIMAL, BOOLEAN, LONG, MONEY, NUMBER, PERCENT, STRING, ENUM, KEY |

| EQUALS_CASE_SENSITIVE | ONE_VALUE | STRING, BOOLEAN, DATE, NUMBER, ENUM, KEY |

| MORE_THAN | ONE_VALUE | BIG_DECIMAL, NUMBER, MONEY |

| LESS_THAN | ONE_VALUE | BIG_DECIMAL, NUMBER, MONEY |

| BETWEEN | TWO_VALUES | BIG_DECIMAL, NUMBER, MONEY, DATE, DATE_TIME |

| ON | ONE_VALUE | DATE, DATE_TIME |

| AFTER | ONE_VALUE | DATE, DATE_TIME |

| BEFORE | ONE_VALUE | DATE, DATE_TIME |

| BEFORE_INCLUSIVE | ONE_VALUE | DATE, DATE_TIME |

| STARTS_WITH | ONE_VALUE | STRING |

| STARTS_WITH_CASE_SENSITIVE | ONE_VALUE | STRING |

| IN | LIST | ENUM,KEY |

| TODAY | NO_VALUE | DATE, DATE_TIME |

| THIS_WEEK | NO_VALUE | DATE, DATE_TIME |

| THIS_MONTH | NO_VALUE | DATE, DATE_TIME |

| THIS_YEAR | NO_VALUE | DATE, DATE_TIME |

| LAST_DAYS | ONE_VALUE | NUMBER |

| EMPTY | NO_VALUE | BIG_DECIMAL, LONG, MONEY, NUMBER, PERCENT, STRING, ENUM, KEY, DATE, DATE_TIME |

| NOT_EMPTY | NO_VALUE | BIG_DECIMAL, LONG, MONEY, NUMBER, PERCENT, STRING, ENUM, KEY, DATE, DATE_TIME |

Considerations for specific field types

-

The

DATE_TIMEoperator: When using aDATE_TIMEoperator, you can opt to provide the time offset for your timezone or use UTC. For example, searching for records that were created after aDATE_TIMEof2022-04-25T13:00:00+02:00should give you the same results as using the UTC equivalent date time of2022-04-25T11:00:00+00:00. When using just the date, the local time zone will always be used. -

The

BEFOREoperator: When using aBEFOREoperator for dates, the date provided will not be included. If you wish to include the date provided, use theBEFORE_INCLUSIVEoperator. -

The

BETWEENoperator: When using theBETWEENoperator with two dates, the start date (valueparameter) will be inclusive while the end date (secondValueparameter) will be exclusive. This means that if you wish to include a record in your results that, for example, took place at 12:00pm on the 22nd July 2023, you should use22023-07-22T12:01:00as your end timestamp. -

The

EQUALSandEQUALS_CASE_SENSITIVEoperators: If usingEQUALSas the operator, true or false values are cast to boolean sotrue,"true", and"TRUE"should all yield the same results. This includes checkbox type custom field definitions where the value is returned as an uppercase string of either"TRUE"or"FALSE". This is not the case when usingEQUALS_CASE_SENSITIVEas the operator, so, if searching based on a checkbox type custom field definition with theEQUALS_CASE_SENSITIVEoperator, you will need to provide the value as an uppercase string.

Optimising Searches

There are a few ways to make sure that your searches are optimised for performance. This becomes increasingly necessary the more records there are in the system.

- Make use of the

EQUALS_CASE_SENSITIVEoperator: We recommend that you do not use the EQUALS operator, as it causes performance issues with larger data sets. Using the EQUALS_CASE_SENSITIVE operator can provide much faster results. The EQUALS operator will transform field values to lowercase before testing against the filter criteria, leading to performance issues. - Make use of pagination for broad searches: If your searches are returning a lot of results, use pagination options provided by the

offsetandlimitquery parameters to break up large results sets into smaller chunks. This will make both results faster and allow you to process less data at a time on your end. For more information, see Pagination. - Keep offset query parameter low: Use a low value for the query offset pararemeter. Consider adding a supplementary filter or change the value for existing filters to have a lower total number of results rather than have a high offset value. This keeps latency down for your requests.

- Make use of the limit parameter for single record searches: If you are making a search for something that should only return exactly one result, for example, an account by ID or encoded key, setting a

limitof1will be more performant than making the same search query with no limit provided. For more information, see Pagination. - Use indexed fields for search: For a given entity, certain fields will be indexed in the database. Searching using these fields can dramatically speed up performance. If you have access to a database clone, you can use a GUI to list all indexed fields or an SQL query such as:

SELECT DISTINCT TABLE_NAME, INDEX_NAME, COLUMN_NAME FROM INFORMATION_SCHEMA.STATISTICS. - Do not request full details if they are not required: In most cases, we recommend keeping the default value for the

detailsLevelquery parameter, which isBASICand then using the results to make subsequent requests to aGETendpoint using an encoded key or ID. For more information, see Details Level . - Time box queries: If you are only interested in results occurring over a given time frame, for example, transactions for a given month or quarter, you can use the

BEFOREandAFTERoperators to avoid making searches over the entire database. - Do not include null values if they are not needed: If you do not want to search for a field using a null value, do not include null values in the payload of the search request.

Time Zone Offsets

Here is how we handle time zone offsets in API v2 calls:

- We use the following standard date format: ISO_8601_FORMAT_DATE_TIME = "YYYY-MM-DD'T'hh:mm:ss±hh:mm".

- We calculate the offset for the date sent by the client, at that moment in time, taking into consideration the tenant’s time zone. For example: "−05:00" for New York on standard time (UTC-05:00), "−04:00" for New York on daylight saving time (UTC-04:00).

- We compare the offset value sent by the client with the offset value calculated by us. If they don’t match an exception is thrown which informs the client about the correct offset. See example.

Example JSON body showing an invalid date offset request

{

"errors": [

{

"errorCode": 4,

"errorSource": "Invalid date offset for value 2021-03-09T13:37:50 org offset is +02:00",

"errorReason": "INVALID_PARAMETERS"

}

]

}

Example

Each Mambu tenant has one time zone. Let’s take for example tenants in the East European time zone (UTC+02:00).

| Date and time of request | Error message or What is saved in the database |

|---|---|

| 2021-03-09T13:37:50 | “Invalid date offset for value 2021-03-09T13:37:50 org offset is +02:00” |

| 2021-03-09T13:37:50+03:00 | “Invalid date offset for value 2021-03-09T13:37:50 org offset is +02:00” |

| 2021-03-09T13:37:50+02:00 | 2021-03-09 13:37:50 |

Using Custom Fields

Overview

Standard custom field set with custom field values

{

...

"_customFieldSet": {

"customFieldDefinitionId1": "value",

"customFieldDefinitionId2": "value",

"customFieldDefinitionId3": "value"

}

...

}

Grouped custom field set with custom field values

{

...

"_customFieldSet": [

{

"_index": "0",

"customFieldDefinitionId1": "value",

"customFieldDefinitionId2": "value",

"customFieldDefinitionId3": "value"

},

{

"_index": "1",

"customFieldDefinitionId1": "value",

"customFieldDefinitionId2": "value",

"customFieldDefinitionId3": "value"

}

]

...

}

Custom fields are fields you may create for several entities that allow you to capture additional relevant information and they are grouped together in custom field sets.

A custom field consists of the custom field definition and the custom field value. The custom field definition is the custom field you create using either the Mambu UI or API which contains information such as its name, ID, type, and usage settings. The custom field value is the actual value that a custom field attached to an entity holds. For more information about custom fields, how to create them, and which entities support them, see Custom Fields in our User Guide.

In API v2, if a JSON object includes a custom field value, then at the end of the JSON object, there will be a custom field set property which will contain the custom field definition ID and the custom field value.

There are two kinds of custom field sets, standard and grouped.

A standard custom field set can contain multiple single custom field definitions. Each custom field definition may contain only one value. In a JSON object, it is represented by a custom field set property that contains an object with the associated custom field values.

A grouped custom field set contains groups of custom field definitions. You may have multiple groups of custom field definitions within the custom field set. In a JSON object, it is represented by a custom field set property that contains an array of objects with the associated custom field values and the index of each object in the array.

The type of custom field set dictates how custom field definitions and their values must be handled in PATCH operations.

To the right you can see an example of a single custom field set and a grouped custom field set.

You can identify any custom field set because the ID starts with an underscore _. To retrieve the custom field values of any object, you must set the detailsLevel query parameter to FULL when making a request. For more information, see Details Level.

You may make PATCH requests to add, replace, or remove a custom field value that you have appropriate access to. We will provide more details on how to perform PATCH requests below. For more information on how access to custom field values is managed, see Custom Fields - Configuring rights for roles.

Example JSON body of a loan showing a standard custom field set with custom field values nested below

{

"id": "ABC001",

"loanName": "Mortgage Loan",

"loanState": "PARTIAL_APPLICATION",

...

"_loanPerformanceScore": { //custom field set

"amountScore": "10", //custom field values nested under the set

"timeScore": "5"

}

}

Example JSON body of a client showing a grouped custom field set with custom field values nested below

{

"encodedKey": "8a19aad43801888d017801f0dd841c1d",

"id": "190955358",

"state": "ACTIVE",

"creationDate": "2021-03-05T11:31:05+01:00",

"lastModifiedDate": "2022-08-08T12:42:35+02:00",

"activationDate": "2021-11-18T10:19:13+01:00",

"approvedDate": "2021-03-05T11:31:05+01:00",

"firstName": "John ",

"lastName": "Smith ",

...

"_assets": [ //custom field set

{ //custom field values in groups nested under the set

"_index": "0",

"asset_value": "965000",

"asset_type": "land",

"asset_age": "10"

},

{

"_index": "1",

"asset_value": "25,000",

"asset_type": "car",

"asset_age": "2"

}

]

}

Example

To the right you can see an example of a standard custom field set with ID _loanPerformanceScore that includes two custom field definitions with IDs amountScore and timeScore and their values.

To the right you can see an example of a grouped custom field set with ID _assets and three custom field definitions with IDs asset_age, asset_type, and asset_value and their values.

Standard custom field sets

In the examples provided for standard custom fields sets, we assume we have a custom field set with ID _employer_information and it contains a total of two custom field definitions with IDs company and position.

Standard custom field set examples:

Affecting a single custom field value in a custom field set

Adding a value to a single custom field definition in a custom field set

[

{

"op": "ADD",

"path": "/_employer_information/company",

"value": "Google"

}

]

To add, replace, or remove a value for a single custom field definition in a custom field set, pass the custom field set ID and the custom field definition ID to the path property. To add or replace a value, enter it directly to the value property. To remove a value, do not include the value property in the JSON object.

In the example to the right, we are adding a value for the company custom field definition.

Affecting all the custom field definitions in a custom field set

Replacing all the custom field values in a custom field set

[

{

"op": "REPLACE",

"path": "/_employer_information",

"value": {

"company": "Amazon",

"position": "senior frontend developer"

}

}

]

To add, replace, or remove all the custom field values in a custom field set, pass the custom field set ID to the path property. To add or replace values, provide an object with all the custom field values within the custom field set to the value property including the custom field value you are adding or replacing. To remove values, do not include the value property in the JSON object.

In the example to the right, we are replacing the values for both the company and position custom field definitions.

In the first example to the right, we are removing the value for the company custom field definition.

In the second example to the right, we are removing the values for all the custom field definitions in the _employer_information custom field set.

Removing one custom field value from the custom field set

[

{

"op": "REMOVE",

"path": "/_employer_information/company"

}

]

Removing all the custom field values from a custom field set

[

{

"op": "REMOVE",

"path": "/_employer_information"

}

]

Grouped custom field sets

Grouped custom field set examples

In the group custom field set examples, we assume we have a custom field set with ID _assets and it contains groups of three custom field definitions with IDs asset_type, asset_value, and asset_age. These are used to capture the client assets that are used as guarantees for loans.

Affecting one custom field value in a custom field group

Adding one custom field value in a custom field group

[

{

"op": "ADD",

"path": "/_assets/2/asset_age",

"value": "5"

}

]

Adding two custom field groups to a custom field set

[

{

"op": "ADD",

"path": "/_assets",

"value": [

{

"asset_type": "Land",

"asset_age": "10",

"asset_value": "965000"

},

{

"asset_type": "Car",

"asset_age": "2",

"asset_value": "25000"

}

]

}

]

To add, replace, or remove a single custom field value within a custom field group, the path property must specify the custom field set ID, the index of the group in the array, and the specific custom field definition.

In the example to the right, we are adding a value for the asset_age property for the custom field group with index 2 in the array.

Adding entire custom field groups to a custom field set

To add an entire new custom field group or multiple new groups, the path property must specify just the custom field set ID. The new group will always be added to the end of the array. You cannot specify a specific index in the array to add it to.

In the example to the right, we are adding two new custom field groups to the custom field set.

Replacing or removing one custom field group in a custom field set

Replacing one custom field group in a custom field set

[

{

"op": "REPLACE",

"path": "/_assets/2",

"value": {

"asset_type": "House",

"asset_age": "3",

"asset_value": "100000"

}

}

]

To replace or remove an entire custom field group, the path property must specify the custom field set ID and the index of the group in the array.

In the example to the right, we are replacing the entire custom field group that is at index 2 in the array.

Replacing or removing all custom field groups in a custom field set

Removing all the custom field groups in a custom field set

[

{

"op": "REMOVE",

"path": "/_assets"

}

]

To replace or remove all the custom field groups for a custom field set, the path property only needs the custom field set ID.

In the example to the right we are removing the custom field group at index 2 in the array.

Accounting Interest Accrual

Allows search of interest accrual breakdown entries by various criteria.

searchInterestAccrual (Accounting Interest Accrual)

Code samples

# You can also use wget

curl -X POST /accounting/interestaccrual:search \

-H 'Content-Type: application/json' \

-H 'Accept: application/vnd.mambu.v2+json'

POST /accounting/interestaccrual:search HTTP/1.1

Content-Type: application/json

Accept: application/vnd.mambu.v2+json

var headers = {

'Content-Type':'application/json',

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: '/accounting/interestaccrual:search',

method: 'post',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Content-Type' => 'application/json',

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.post '/accounting/interestaccrual:search',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.post('/accounting/interestaccrual:search', params={

}, headers = headers)

print r.json()

'application/json',

'Accept' => 'application/vnd.mambu.v2+json',

);

$client = new \GuzzleHttp\Client();

// Define array of request body.

$request_body = array();

try {

$response = $client->request('POST','/accounting/interestaccrual:search', array(

'headers' => $headers,

'json' => $request_body,

)

);

print_r($response->getBody()->getContents());

}

catch (\GuzzleHttp\Exception\BadResponseException $e) {

// handle exception or api errors.

print_r($e->getMessage());

}

// ...

URL obj = new URL("/accounting/interestaccrual:search");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Content-Type": []string{"application/json"},

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("POST", "/accounting/interestaccrual:search", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

POST /accounting/interestaccrual:search

Allows search of interest accrual breakdown entries by various criteria.

For more information on performing searches, please read the Searching for Records section above.

Body parameter

{

"filterCriteria": [

{

"field": "entryId",

"operator": "EQUALS",

"secondValue": "string",

"value": "string",

"values": [

"string"

]

}

],

"sortingCriteria": {

"field": "entryId",

"order": "ASC"

}

}

Parameters

| Name | Type | Description | In |

|---|---|---|---|

| offset | integer(int32) | Pagination, index to start searching at when retrieving elements, used in combination with limit to paginate results | query |

| limit | integer(int32) | Pagination, the number of elements to retrieve, used in combination with offset to paginate results | query |

| paginationDetails | string | Flag specifying whether the pagination details should be provided in response headers. Please note that by default it is disabled (OFF), in order to improve the performance of the APIs | query |

| detailsLevel | string | The level of details to return: FULL means the full details of the object will be returned (custom field values, address, contact info, or any other related objects) and BASIC will return only the first level elements of the object. |

query |

| body | InterestAccrualSearchCriteria | Represents the filtering criteria and a sorting criteria to search interest accrual breakdown. | body |

Enumerated Values

| Parameter | Value |

|---|---|

| paginationDetails | ON |

| paginationDetails | OFF |

| detailsLevel | BASIC |

| detailsLevel | FULL |

Example responses

200 Response

[

{

"accountId": "string",

"accountKey": "string",

"amount": 0,

"bookingDate": "string",

"branchKey": "string",

"branchName": "string",

"creationDate": "string",

"entryId": 0,

"entryType": "string",

"foreignAmount": {

"accountingRate": {

"encodedKey": "string",

"endDate": "2016-09-06T13:37:50+03:00",

"fromCurrencyCode": "string",

"rate": 0,

"startDate": "2016-09-06T13:37:50+03:00",

"toCurrencyCode": "string"

},

"amount": 0,

"currency": {

"code": "AED",

"currencyCode": "string"

}

},

"glAccountId": "string",

"glAccountKey": "string",

"glAccountName": "string",

"glAccountType": "string",

"parentEntryId": 0,

"productId": "string",

"productKey": "string",

"productType": "string",

"transactionId": "string"

}

]

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

200 |

OK | Interest accrual breakdown returned. | Inline |

400 |

Bad Request | A validation error occurred | ErrorResponse |

401 |

Unauthorized | Unauthorized | ErrorResponse |

403 |

Forbidden | Forbidden | ErrorResponse |

Response Schema

Status Code 200

| Name | Type | Description | Restrictions |

|---|---|---|---|

| anonymous | [InterestAccrualBreakdown] | [Represents an interest accrual breakdown entry.] | none |

| » accountId | string | The loan or deposit account ID for which interest is accrued. | none |

| » accountKey | string | The encoded key of the loan or deposit account for which interest is accrued. | none |

| » amount | number | The interest accrued amount for the account in this entry. | none |

| » bookingDate | string | The booking date in the organization's timezone. | none |

| » branchKey | string | The encoded key of the account's branch. | none |

| » branchName | string | The name of the account's branch | none |

| » creationDate | string | The creation date and time of the entry in UTC. | none |

| » entryId | integer(int64) | The generated ID of the interest accrual per account entry. | none |

| » entryType | string | Debit or Credit. | none |

| » foreignAmount | ForeignAmount | Represents the details of general ledger journal entries posted in foreign currency. | none |

| »» accountingRate | AccountingRate | Represents the conversion rate used in accounting to convert amounts from one currency to organisation currency | none |

| »»» encodedKey | string | The encoded key of the accounting rate, auto generated, unique | read-only |

| »»» endDate | string(date-time) | Rate validity end date (as Organization Time) | none |

| »»» fromCurrencyCode | string | Organisation currency code | none |

| »»» rate | number | Value of rate to be used for accounting conversions | none |

| »»» startDate | string(date-time) | Rate validity start date (as Organization Time) | none |

| »»» toCurrencyCode | string | Foreign currency code | none |

| »» amount | number | The foreign currency amount of the accounting entry. | none |

| »» currency | Currency | Represents a currency. To represent a fiat currency, the code value and the currencyCode value must be the ISO-4217 currency code of the fiat currency. To represent a non-fiat currency, the code value must be NON_FIAT and the currencyCode value must be the currency code of the non-fiat currency. |

none |

| »»» code | string | Fiat(ISO-4217) currency code or NON_FIAT for non fiat currencies. | none |

| »»» currencyCode | string | Currency code for NON_FIAT currency. | none |

| » glAccountId | string | The ID of the general ledger account. | none |

| » glAccountKey | string | The encoded key of the general ledger account used for logging the interest accrual. | none |

| » glAccountName | string | The name of the general ledger account. | none |

| » glAccountType | string | The general ledger account type, which can be: ASSET, LIABILITY, EQUITY, INCOME, or EXPENSE. |

none |

| » parentEntryId | integer(int64) | The ID of the general ledger journal entry that logged the interest accrual sum for all accounts of the same product. | none |

| » productId | string | The ID of the account's product. | none |

| » productKey | string | The encoded key of the account's product. | none |

| » productType | string | The product type. | none |

| » transactionId | string | The journal entry transaction ID. | none |

Enumerated Values

| Property | Value |

|---|---|

| code | AED |

| code | AFN |

| code | ALL |

| code | AMD |

| code | ANG |

| code | AOA |

| code | ARS |

| code | AUD |

| code | AWG |

| code | AZN |

| code | BAM |

| code | BBD |

| code | BDT |

| code | BGN |

| code | BHD |

| code | BIF |

| code | BMD |

| code | BND |

| code | BOB |

| code | BOV |

| code | BRL |

| code | BSD |

| code | BTN |

| code | BWP |

| code | BYR |

| code | BYN |

| code | BZD |

| code | CAD |

| code | CDF |

| code | CHE |

| code | CHF |

| code | CHW |

| code | CLF |

| code | CLP |

| code | CNY |

| code | COP |

| code | COU |

| code | CRC |

| code | CUC |

| code | CUP |

| code | CVE |

| code | CZK |

| code | DJF |

| code | DKK |

| code | DOP |

| code | DZD |

| code | EGP |

| code | ERN |

| code | ETB |

| code | EUR |

| code | FJD |

| code | FKP |

| code | GBP |

| code | GEL |

| code | GHS |

| code | GIP |

| code | GMD |

| code | GNF |

| code | GTQ |

| code | GYD |

| code | HKD |

| code | HNL |

| code | HRK |

| code | HTG |

| code | HUF |

| code | IDR |

| code | ILS |

| code | INR |

| code | IQD |

| code | IRR |

| code | ISK |

| code | JMD |

| code | JOD |

| code | JPY |

| code | KES |

| code | KGS |

| code | KHR |

| code | KMF |

| code | KPW |

| code | KRW |

| code | KWD |

| code | KYD |

| code | KZT |

| code | LAK |

| code | LBP |

| code | LKR |

| code | LRD |

| code | LSL |

| code | LTL |

| code | LVL |

| code | LYD |

| code | MAD |

| code | MDL |

| code | MGA |

| code | MKD |

| code | MMK |

| code | MNT |

| code | MOP |

| code | MRO |

| code | MRU |

| code | MUR |

| code | MVR |

| code | MWK |

| code | MXN |

| code | MXV |

| code | MYR |

| code | MZN |

| code | NAD |

| code | NGN |

| code | NIO |

| code | NOK |

| code | NPR |

| code | NZD |

| code | OMR |

| code | PAB |

| code | PEN |

| code | PGK |

| code | PHP |

| code | PKR |

| code | PLN |

| code | PYG |

| code | QAR |

| code | RON |

| code | RSD |

| code | RUB |

| code | RWF |

| code | SAR |

| code | SBD |

| code | SCR |

| code | SDG |

| code | SEK |

| code | SGD |

| code | SHP |

| code | SLL |

| code | SOS |

| code | SRD |

| code | STD |

| code | STN |

| code | SVC |

| code | SYP |

| code | SZL |

| code | THB |

| code | TJS |

| code | TMT |

| code | TND |

| code | TOP |

| code | TRY |

| code | TTD |

| code | TWD |

| code | TZS |

| code | UAH |

| code | UGX |

| code | USD |

| code | USN |

| code | UYI |

| code | UYU |

| code | UYW |

| code | UZS |

| code | VED |

| code | VEF |

| code | VES |

| code | VND |

| code | VUV |

| code | WST |

| code | XAG |

| code | XAU |

| code | XAF |

| code | XBA |

| code | XBB |

| code | XBC |

| code | XBD |

| code | XCD |

| code | XDR |

| code | XOF |

| code | XPD |

| code | XPF |

| code | XPT |

| code | XSU |

| code | XTS |

| code | XUA |

| code | XXX |

| code | YER |

| code | ZAR |

| code | ZMK |

| code | ZWL |

| code | ZMW |

| code | SSP |

| code | NON_FIAT |

Accounting Rates

Create Accounting Rates.

getAll (Accounting Rates)

Code samples

# You can also use wget

curl -X GET /currencies/{currencyCode}/accountingRates \

-H 'Accept: application/vnd.mambu.v2+json'

GET /currencies/{currencyCode}/accountingRates HTTP/1.1

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: '/currencies/{currencyCode}/accountingRates',

method: 'get',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.get '/currencies/{currencyCode}/accountingRates',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.get('/currencies/{currencyCode}/accountingRates', params={

}, headers = headers)

print r.json()

'application/vnd.mambu.v2+json',

);

$client = new \GuzzleHttp\Client();

// Define array of request body.

$request_body = array();

try {

$response = $client->request('GET','/currencies/{currencyCode}/accountingRates', array(

'headers' => $headers,

'json' => $request_body,

)

);

print_r($response->getBody()->getContents());

}

catch (\GuzzleHttp\Exception\BadResponseException $e) {

// handle exception or api errors.

print_r($e->getMessage());

}

// ...

URL obj = new URL("/currencies/{currencyCode}/accountingRates");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("GET");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("GET", "/currencies/{currencyCode}/accountingRates", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

GET /currencies/{currencyCode}/accountingRates

Get accounting rates

Parameters

| Name | Type | Description | In |

|---|---|---|---|

| currencyCode (required) | string | The currency code. | path |

| offset | integer(int32) | Pagination, index to start searching at when retrieving elements, used in combination with limit to paginate results | query |

| limit | integer(int32) | Pagination, the number of elements to retrieve, used in combination with offset to paginate results | query |

| paginationDetails | string | Flag specifying whether the pagination details should be provided in response headers. Please note that by default it is disabled (OFF), in order to improve the performance of the APIs | query |

| from | string(date-time) | The date and time of the Accounting Rates to search from | query |