Welcome

This documentation was last updated on Fri Nov 21 09:30:45 UTC 2025 and covers Mambu Version v9.183.3

Welcome to the Mambu API v2 documentation. Here you can learn everything you need to know about API v2 and how to interact with Mambu!

We offer language bindings in cURL, HTTP, JavaScript, Node.js, Ruby, Python, Java, and Go. You can view code examples in the dark area to the right, and you can switch the programming language of the examples with the tabs at the top right.

You can also download OpenAPI specifications for all of our endpoints which can be used to generate client SDKs, interactive documentation, create mock servers and more. For more information, see the OpenAPI specification section.

About Mambu API v2

Scroll down for code samples, example requests, and responses. Select a language for code samples from the tabs above or the mobile navigation menu.

Mambu API v2 is a fully compliant RESTful API and we recommend building all new integrations with API v2 (instead of API v1).

Mambu APIs allow users to perform many tasks, including:

- create clients, loan accounts, or savings accounts

- make transactions

- manage system configuration

- set up branches

- configure interest rates

- manage API keys, user roles, and access permissions

- and much, much more

Providing so much functionality via API is a cornerstone of our "composable banking" ethos, allowing you to easily build up your business around Mambu's Core Banking feature set or just dip in to our complete feature set to take advantage of the features you need, such as our trusted general ledger solution.

Mambu APIs

- API v2: APIs for our core banking platform. These provide access to our most widely used features such as client & account management, transactions & general ledger journal entries, tasks and system configuration. This is likely the first point of reference when building integrations and custom tools.

- API v1: Our legacy core banking API; while we recommend that all new integrations are built using our v2 APIs, these endpoints and their documentation are retained for existing customers who may still be using them in legacy integrations. For more information, see Using API v1 and API v2.

- Payments API: Our payments product helps customers support national and international, standards-based schemes, including SEPA. APIs are provided for making and receiving payments and inquiries as well as mapping Mambu accounts to international account numbering systems such as IBAN and communicating with partners to deliver anti-money laundering measures and other requirements.

- Streaming API: Our streaming API is an enterprise feature which allows customers to set up configurable event feeds that can be used to power your own banking ecosystem, be it communication tool CRMs or your own auditing and logging system.

Using API v1 and API v2

API v1 is no longer being actively developed. We strongly recommend that all customers use our API v2 endpoints for all new integrations and transition to API v2 endpoints for existing features wherever possible.

API v2 can however be used in parallel with API v1, as they do not conflict.

Request versioning is supported via the Accept header. An Accept header is required for all API v2 requests.

Example:

Accept: application/vnd.mambu.v2+json

or

Accept: application/vnd.mambu.v2+yaml

Base URLs

The base URL for requests to the API is:

https://TENANT_NAME.mambu.com/api

To make requests to your tenant's sandbox, use the following base URL:

https://TENANT_NAME.sandbox.mambu.com/api

For more information, see the Sandbox section.

HTTP Verbs

Standard HTTP verbs are used to indicate the API request method.

| Verb | Function |

|---|---|

GET |

To retrieve a resource or a collection of resources |

POST |

To create a resource |

PATCH |

To modify an existing resource |

PUT |

To replace an existing resource |

DELETE |

To delete a resource |

Authentication

Mambu supports two methods for authenticating API requests:

- Basic authentication, using Mambu UI login credentials for a user account with API access permissioƒns.

- API keys, which are unique UUID tokens provided in an

apiKeyheader (Early Access feature).

Basic Authentication

curl --location --request GET 'https://TENANT_NAME.mambu.com/api/users' \

--header 'Authorization: Basic U29tZVVzZXI6T3BlblNlc2FtZQ=='

GET /api/users HTTP/1.1

Host: TENANT_NAME.mambu.com

Authorization: Basic U29tZVVzZXI6T3BlblNlc2FtZQ==

var settings = {

"url": "https://TENANT_NAME.mambu.com/api/users",

"method": "GET",

"timeout": 0,

"headers": {

"Authorization": "Basic U29tZVVzZXI6T3BlblNlc2FtZQ=="

},

};

$.ajax(settings).done(function (response) {

console.log(response);

});

require "uri"

require "net/http"

url = URI("https://TENANT_NAME.mambu.com/api/users")

https = Net::HTTP.new(url.host, url.port)

https.use_ssl = true

request = Net::HTTP::Get.new(url)

request["Authorization"] = "Basic U29tZVVzZXI6T3BlblNlc2FtZQ=="

response = https.request(request)

puts response.read_body

import requests

url = "https://TENANT_NAME.mambu.com/api/users"

payload={}

headers = {

'Authorization': 'Basic U29tZVVzZXI6T3BlblNlc2FtZQ=='

}

response = requests.request("GET", url, headers=headers, data=payload)

print(response.text)

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

Request request = new Request.Builder()

.url("https://TENANT_NAME.mambu.com/api/users")

.method("GET", null)

.addHeader("Authorization", "Basic U29tZVVzZXI6T3BlblNlc2FtZQ==")

.build();

Response response = client.newCall(request).execute();

package main

import (

"fmt"

"net/http"

"io/ioutil"

)

func main() {

url := "https://TENANT_NAME.mambu.com/api/users"

method := "GET"

client := &http.Client {

}

req, err := http.NewRequest(method, url, nil)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Authorization", "Basic U29tZVVzZXI6T3BlblNlc2FtZQ==")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

For basic authorization, provide your username and password directly via the Authorization header in the format Basic {base64-encoded-string}, where base64-encoded-string is the base-64-encoded value of your username and password separated by a colon ':'.

For example, a user with the username SomeUser and the password OpenSesame would take the value SomeUser:OpenSesame and base-64 encode it, yielding U29tZVVzZXI6T3BlblNlc2FtZQ==. They would then provide an Authorization header for their request with the value Basic U29tZVVzZXI6T3BlblNlc2FtZQ==.

See the code samples for this section for sample GET requests to the /users endpoint using the above example.

Note that the login credentials must be for a user account with API access permissions. For more information, see Creating a User - Access Rights in our User Guide.

API Keys

API keys are tokens that you provide in an apiKey header to authenticate requests. They are generated by API consumers, which are an abstraction similar to an OAuth client.

API consumers are currently an Early Access feature. If you would like to request access to this feature, please get in touch with your Mambu Customer Success Manager to discuss your requirements.

For more information on API consumers and keys, see API Consumers in our User Guide.

Versioning

# You can also use wget

curl -X {HTTP Verb} https://TENANT_NAME.mambu.com/api/{Insert resource URI here} \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'TENANT_NAME.mambu.com/api/{Insert resource URI here}',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Mambu API v2 provides a versioning system to assist with backwards compatibility. Contract changes will result in a new version of each affected resource becoming available without the old version immediately becoming obsolete.

Versioning is supported in API requests via the Accept header.

Template: application/vnd.mambu.{version}+json

To retrieve a specific version of an entity, fill a value into the template above.

The highest currently supported version is v2.

Payloads

Mambu API v2 currently has endpoints that accept and return either application/json, application/yaml, or multipart/form-data payloads.

When making a POST, PUT, or PATCH request, you must use the Content-Type header to specify the content type of the payload.

Requests

Code samples

# You can also use wget

curl -X {HTTP Verb} https://TENANT_NAME.mambu.com/api/{Insert resource URI here} \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

API requests (also known as API calls) to the Mambu API identify who the requester is and exactly what information they wish to retrieve or which action they wish to perform.

To put together an API request you will need to combine:

- The HTTP verb

- The full URI to the resource

- HTTP headers, for example, headers for authentication, versioning, and payload content types

- The payload (if required)

Responses

Error Response

{

"errorCode":"4",

"errorSource":"Property scheduleSettings.repaymentInstallments may not be null",

"errorReason":"INVALID_PARAMETERS"

}

The response to a request will contain either an error response or a payload in the content type that the endpoint accepts.

Error response

An error response will consist of:

| Field | Type | Availability | Content |

|---|---|---|---|

errorCode |

number | Always present | A unique error code. For more information, see API Responses and Error Codes. |

errorSource |

string | Sometimes present | A human-readable message capturing unsatisfied constraints. |

errorReason |

string | Always present | A human-readable message stating the general category of the failure. |

Idempotency

Code samples

# You can also use wget

curl -X POST https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions \

-H 'Content-Type: application/json' \

-H 'Accept: application/vnd.mambu.v2+json' \

-H 'Idempotency-Key: 01234567-9abc-def0-1234-56789abcdef0'

POST https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions HTTP/1.1

Host: TENANT_NAME.mambu.com

Content-Type: application/json

Accept: application/vnd.mambu.v2+json

Idempotency-Key: 01234567-9abc-def0-1234-56789abcdef0

var headers = {

'Content-Type':'application/json',

'Accept':'application/vnd.mambu.v2+json',

'Idempotency-Key':'01234567-9abc-def0-1234-56789abcdef0'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions',

method: 'post',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Content-Type' => 'application/json',

'Accept' => 'application/vnd.mambu.v2+json',

'Idempotency-Key' => '01234567-9abc-def0-1234-56789abcdef0'

}

result = RestClient.post 'https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/vnd.mambu.v2+json',

'Idempotency-Key': '01234567-9abc-def0-1234-56789abcdef0'

}

r = requests.post('https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

String idempotentKey = UUID.randomUUID().toString();

con.setRequestProperty(“Idempotency-Key”, idempotentKey);

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Content-Type": []string{"application/json"},

"Accept": []string{"application/vnd.mambu.v2+json"},

"Idempotency-Key": []string{"01234567-9abc-def0-1234-56789abcdef0"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("POST", "https://TENANT_NAME.mambu.com/api/deposits/{depositAccountId}/transactions", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Idempotent requests to the Mambu API are guaranteed to be executed no more than once.

Working with financial transactions, it is important to ensure some requests are not repeated for any reason, which may result in data loss or accidental duplication. You may configure requests to be idempotent by providing an Idempotency-Key header and providing a unique UUID token for the request. This will guard against the possibility of error if a request must be retried.

When an idempotent request is processed, the status code and body of the response is associated with the idempotency key and stored in a cache. If the request is duplicated for any reason, the duplicate request will not be processed, and the response will be re-sent to the client.

Idempotent requests that fail at the server level such validation failures are not stored in the cache. Subsequent requests with the same idempotency key will be processed as if they were new, receiving the same 400 BAD REQUEST status code.

For examples of idempotent requests, see the code samples for this section.

Idempotency Keys and Retry Mechanisms

Idempotency keys must use the v4 UUID format (32 hexadecimal digits, in a 8-4-4-4-12 arrangement, such as 01234567-9abc-def0-1234-56789abcdef0).

We recommend generating UUIDs programmatically or by using an online generator such as UUID Generator to ensure that all keys are valid V4 UUIDs.

Retry mechanisms must:

- Use the same key for initial calls and retries.

- Retry at a reasonable frequency so as not to overload the API.

- Properly identify and handle error codes.

Sandbox

The sandbox tenant (also known as sandbox environment) is independent from the production tenant, and any changes you make in the sandbox will not affect the data in your production tenant. For more information, see Sandbox in our User Guide.

To make requests to your tenant's sandbox, use the following base URL:

https://TENANT_NAME.sandbox.mambu.com/api/

The sandbox is generally one version ahead of the production tenant. As such, it may include changes that are currently in, or may soon be in, the production environment. For more information, see Mambu Release Cycle.

Sandbox management

To manage your sandbox go to the Customer Service Portal. For more information and instructions, see Customer Service Portal - Sandbox Management.

Pagination

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here?offset=10&limit=10&paginationDetails=ON HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?offset=10&limit=10&paginationDetails=ON", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Response headers

(...)

content-type: application/vnd.mambu.v2+json

date: Mon, 03 Sep 2018 10:56:15 GMT

items-limit: 10

items-offset: 10

items-total: 35

(...)

Mambu API v2 has customisable pagination capabilities which can be used with all GET requests. It also has sorting and filtering capabilities for search endpoints.

We strongly recommend using the pagination, sorting, and filtering capabilities when making requests which will return a large number of records because response times are much faster.

Pagination query parameters

Pagination is deactivated by default and must be specified in each request. There are three available query parameters you may use, paginationDetails, offset, and limit.

paginationDetails

The paginationDetails query parameter returns pagination details in the header of your response. The default value is OFF. To include pagination details set the value to ON. Pagination details includes the total number of records, the limit value, and the offset value.

limit

The limit query parameter determines the number of records that will be retrieved. The default value is 50. The maximum value is 1,000.

offset

The offset query parameter determines how many records will be skipped before being included in the returned results. The default value is 0.

In the example, we can see that there are 35 total records. By setting offset to 10 and limit to 10, we are returning the second set of 10 records, essentially "Page 2" of our paginated response.

Pagination best practices

Once you have used the pagination query parameters to retrieve all the available records in the database for your specific query, you no longer need to make any additional API requests.

To determine whether you need to make any additional API requests you may compare the value of the limit parameter to the number of records retrieved in the body of your request.

If the number of records is less than the value of the limit parameter then no additional API requests are necessary.

If the number of records is equal to the limit value then you may make additional API requests.

If you receive an empty array [] in the body of your request, this means there are no records for that request and you do not need to make any additional API requests.

Sorting and filtering with search endpoints

All the search endpoints in API v2 end in :search. Search endpoints accept a filterCriteria array of objects and a sortingCriteria object in their request body.

When making broad searches that will return a lot of records, using pagination with appropriate values can ensure that your result set will not shift as new records matching your search criteria are created, which may otherwise lead to duplicates across pages.

sortingCriteria

The sortingCriteria object has two properties, field and order.

field property

We recommend you enter either an incremental ID or a timestamp as the value for the field property.

order property

The order property accepts two values, ascending (ASC) or descending (DESC). The default value is DESC, however, if using pagination or a search where new records are being actively created, for example transactions or journal entries created up to and including the current day, we strongly recommend you set the value to ASC. This will cause new records to be added to the end of your result set.

filterCriteria

If you are making a broad search that will return a lot of results, we recommend constraining your search query using a time interval. This may be done by setting the field property to a date property such as creationDate or valueDate. Setting the operator property to BETWEEN. And entering two dates as the values for the value and secondValue properties. This will ensure that no newly created records will interfere with a set of results. Please see the related note about searches using the BETWEEN operator in the considerations for specific field types section below for more information about this operator.

Details Level

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL \

-H 'Accept: application/vnd.mambu.v2+json'

GET https://TENANT_NAME.mambu.com/api/Insert-Resource-URI-here?detailsLevel=FULL HTTP/1.1

Host: TENANT_NAME.mambu.com

Accept: application/vnd.mambu.v2+json

var headers = {

'Accept':'application/vnd.mambu.v2+json'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL',

method: '{HTTP Verb}',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'Accept' => 'application/vnd.mambu.v2+json'

}

result = RestClient.{HTTP Verb} 'https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'Accept': 'application/vnd.mambu.v2+json'

}

r = requests.{HTTP Verb}('https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty(“Accept”, “application/vnd.mambu.v2+json”);

con.setRequestMethod("{HTTP Verb}");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"Accept": []string{"application/vnd.mambu.v2+json"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("{HTTP Verb}", "https://TENANT_NAME.mambu.com/api/{Insert resource URI here}?detailsLevel=FULL", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Mambu API v2 supports two details levels for responses:

-

BASIC-- By default, API v2 will return theBASIClevel of detail. This includes all first level elements of an object. -

FULL-- This details level includes everything fromBASICas well as all custom field values, any address or contact information, and any other related objects.

To view a higher level of detail, include detailsLevel as a query parameter in your request and give it the value FULL.

Audit Trail and the User-Agent Header

Error when User Agent header is not provided

{

"errors": [

{

"errorCode": 4,

"errorSource": "The user agent cannot be null when the Audit Trail feature is enabled",

"errorReason": "INVALID_PARAMETERS"

}

]

}

Audit trail tracks all activities performed in the Mambu Core Banking system via the UI or API v1 and v2. For more information, see Audit Trail in our User Guide.

When the audit trail feature is enabled, you must provide a User-Agent header for all requests to any endpoint, or the request will fail with the error message The user agent cannot be null when the Audit Trail feature is enabled.

Note that if you are using a REST client like Postman or Curl, this header is probably provided automatically. However, if you generate a request to the API, you must provide it yourself.

The User-Agent header provides information regarding the browser and operating system (such as the browser version), and information about the library or tool issuing the request (such as the client Java version). It is generally used to assist with debugging problems.

Notifications

- Proactive notifications: Where reasonably practicable, Mambu will attempt to notify customers before implementing throttling measures.

- Reactive notifications: In situations requiring immediate action to protect system stability, Mambu may implement throttling measures before notification. In such cases, Mambu will notify customers as soon as reasonably possible.

Contact information

For questions or concerns regarding this policy, please contact Mambu's support team at support@mambu.com.

API Response & Error Codes

For a full list of error code descriptions, refer to this page: API Response and Error Codes.

API Consumers

API consumers are an abstraction similar to an OAuth client. The primary purpose of an API consumer is to generate API keys, which are used to authenticate API requests by including them in an apiKey header.

Mambu currently supports two methods for authenticating API requests:

- Basic authentication using user credentials, or

- API keys, which are individual UUID tokens provided in an

apiKeyheader.

API consumers replace user accounts as the source of access credentials.

API keys inherit the scope of access settings from the API consumer that creates them. For more information, see API consumer access settings and permissions.

It is up to you to determine the right policy governing who has access to API consumers, how and when API keys are generated and expire, when to rotate keys, and so forth. Depending on how you configure your system, multiple users may be able to create and access one or many API consumers with different degrees of access, and each API consumer may generate multiple keys.

Once we have enabled API consumers for your account, you will no longer be able to add the API permission when creating a new user. However, you may edit any existing user to add the permission in Administration > Access > Users. Existing users with API access permissions may continue to use basic authentication.

Managing API consumers

API consumers are managed in two ways:

- Using the Mambu UI. We will cover this process in this article, along with providing a general introduction that will be useful for anyone using or managing API consumers.

- Via the API consumers endpoint. For more information on creating, using, and managing API consumers via API v2, see the API Consumers section of our API Reference.

User permissions for managing API consumers

The following permissions are required for a user to be able to perform the relevant management actions on API consumers either via the UI or API:

- View Api Consumers and Keys (

VIEW_API_CONSUMERS_AND_KEYS) - Create Api Consumers and Keys (

CREATE_API_CONSUMERS_AND_KEYS) - Edit Api Consumers and Keys (

EDIT_API_CONSUMERS_AND_KEYS) - Delete Api Consumers and Keys (

DELETE_API_CONSUMERS_AND_KEYS)

If these permissions are not assigned to a user, that user will not be able to see the API Consumers tab under Administration > Access.

Once we have enabled API consumers for you, an API Consumers tab will appear under Administration > Access.

You may generate and manage API consumers and keys in Administration > Access > API consumers.

You may configure relevant settings in Administration > Access > Preferences.

Creating API consumers

To create an API consumer in the Mambu UI:

- On the main menu, go to Administration > Access > API Consumers.

- Select Add consumer.

- Enter all the necessary information in the Create Api Consumer dialog. For more information about access settings and permissions fields, see API consumer access settings and permissions.

- Select Save Api Consumer.

API consumer access settings and permissions

When you create an API consumer, you must assign the relevant access settings. The API keys that the API consumer creates, will then inherit the access settings scope.

The access settings determine which capabilities an API key may access and which actions it may authorize. They may be assigned either by assigning permissions directly to the API consumer, by assigning a role, or assigning a user type. For more information, see Understanding Users, Roles, and Permissions.

The table shows some of the available capabilities Mambu offers and which permissions an API consumer must have to access them.

| Capability | Permissions | Links for more information |

|---|---|---|

| Audit Trail | Manage Audit Trail (MANAGE_AUDIT_TRAIL) |

Audit Trail |

| Streaming API | Manage Events Streaming (MANAGE_EVENTS_STREAMING) |

Streaming API |

| Payments API | Manage Payments (MANAGE_PAYMENTS) |

Getting Started - Payments |

Deleting API consumers

If you delete an API consumer, any API keys and secret keys the consumer created will be deleted and immediately invalidated as well.

You cannot delete an API consumer after any of its keys has been used. The API consumer will have an activity logged, and it must be maintained for audit trail purposes.

To delete an API consumer:

- On the main menu, go to Administration > Access > API Consumers.

- Find the API consumer in the list that you would like to delete and select Actions > Delete.

- In the Delete dialog, select Delete.

API keys

The primary purpose of an API consumer is to generate API keys, which are used to authenticate API requests by including them in an apiKey header. API keys inherit the access settings scope from the API consumer that was used to create them.

-

One API consumer may generate multiple API keys, and they may be used concurrently.

-

You may optionally set an expiration time for any API key that you create. If you set an expiration time for your API key, the remaining lifetime of the key will be displayed next to the API key in the Manage Keys dialog in the Mambu UI.

-

Because API keys are used to authenticate access to your account, we recommend setting an expiration length for them, rather than creating keys that do not expire.

-

You may invalidate API keys by deleting them in the Mambu UI or API, or by rotating them using secret keys.

Generating API keys

When you generate an API key, it will be presented in clear text only once. After this, you may view the API key ID and a six character clear text prefix of the API key.

Since you are not able to retrieve an API key in clear text after generation, you must store your API key in a secure location upon generation.

Also, the six character API key prefix is not guaranteed to be unique. Therefore, you must base any identification process on the API key ID.

{height="" width=""}

{height="" width=""}

To generate an API key:

- On the main menu, go to Administration > Access > API Consumers.

- Find the API consumer in the list that you would like to make an API key for, select Actions > Manage keys.

- In the Manage Keys dialog, select Generate.

- In the Generate New API Key dialog, you can optionally choose whether you want to enter an expiration time to live (TTL) in seconds.

- Select Generate to finish generating the key.

- Store your API key in a secure location.

Deleting API keys

When you delete an API key from the Mambu UI, it is immediately invalidated. Note that the grace period for key rotation does not apply when keys are deleted.

To delete an API key:

- On the main menu, go to Administration > Access > API Consumers.

- Find the API consumer in the list that you would like to make an API key for, select Actions > Manage keys.

- Find the API key you want to delete in the list and select Delete.

- In the dialog, select Delete.

API key rotation

API key rotation allows you to invalidate specific API keys using a secret key for authentication. When a key is rotated, you will immediately receive a replacement API key and a new secret key in the response body.

You may specify the expiration TTL for the replacement key in the rotation request. If you do not provide an expiration value, and no automatic expiration time is specified in the UI, then the replacement key will never expire. We generally recommend always setting an expiration value for better security.

Note that if an automatic expiration time is configured in Automatic Expiry of API consumer key in the Mambu UI, that value will overwrite any expiration value you provide with your API call. For more information, see Automatic API key expiration for rotated keys.

For more information about the API key rotation endpoint, see the API Key Rotation section of our API Reference.

Secret keys

Secret keys are generated by API consumers, and are used to authenticate API key rotation requests. They cannot be used to validate any other request.

Unless a grace period is configured for key rotation, secret keys expire in 5 minutes, as this is our minimum TTL used in caching for performance purposes. Secret keys otherwise never expire.

You may only have one active secret key per consumer at any one time. The key may not be invalidated, but it may be regenerated through the Mambu UI, which will invalidate any existing key.

To generate a secret key in the Mambu UI:

- On the main menu, go to Administration > Access > API Consumers.

- Find the API consumer in the list that has the API key that you want to rotate and select Actions > Manage keys.

- Select Generate Secret Key.

- In the Generate Secret Key dialog, select Generate.

- Copy the secret key and select Close.

Key rotation grace period

You may configure a grace period for key rotation in the Mambu UI. After a key is rotated, it will still be valid for the length of time specified by the grace period. The grace period applies to both API keys and secret keys.

To set the key rotation grace period:

- On the main menu, go to Administration > Access > Preferences.

- Under API Key Rotation Grace Period, enter the amount of seconds you want the grace period to last.

- Select Save Changes.

Automatic API key expiration for rotated keys

You may configure an expiration value for all API keys generated during key rotation by setting an Automatic Expiry of API Consumer Keys value in the Mambu UI. This value will not affect keys created in the UI, or created using the createApiKeyByConsumer endpoint.

If you set this value, it will override any specified value for key expiration when new keys are generated by key rotation through the API.

If no value is provided in the Automatic Expiry of API Consumer Keys field of the Mambu UI, then rotated API keys will never expire by default.

To set the Automatic Expiry of API Consumer Keys value for keys generated by key rotation:

- On the main menu, go to Administration > Access > Preferences.

- Select the Automatic Expiry of API Consumer Keys checkbox.

- Enter the TTL for the key in seconds.

- Select Save Changes.

Key lifecycle

The table summarizes our key lifecycle policy.

| Key | Where created | Default expiration | Can override? | Default grace period | Can override? |

|---|---|---|---|---|---|

| API Key | API | never | yes | 1800 s | yes |

| API Key | UI | never | yes | 1800 s | yes |

| Secret Key | API | 5 minutes after use | no | 1800 s | yes |

| Secret Key | UI | 5 minutes after use | no | 1800 s | yes |

| API Key | rotation | never | yes | 1800 s | yes |

| Secret Key | rotation | 5 mintes after use | no | 1800 s | yes |

Blocking IP Adresses

Mambu automatically blocks any IP address that issues a total of 10 requests from an API consumer using invalid credentials. This applies even if the IP has been whitelisted. The addresses will be blocked regardless of how much time elapses between calls.

For more information on IP blocking and instructions on how to clear an address from being blocked, see the IP Access Restrictions section of our Access Preferences article.

OpenAPI Specification

This API Reference documentation is automatically generated from OpenAPI Specification (OAS) files.

We allow you to:

- Retrieve a list of all available APIs.

- Retrieve an OAS file in either a basic format (without custom field values) or an enriched format (with custom field values).

You can use the JSON-formatted OAS files to scaffold client SDKs in various languages. See Generating SDKs from OAS below.

OAS v3 API Discovery

Request samples

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/openapi/resources \

-H 'apikey: APIKEY'

GET https://TENANT_NAME.mambu.com/openapi/swagger/resources HTTP/1.1

Host: TENANT_NAME.mambu.com

apikey: APIKEY

var headers = {

'apikey':'APIKEY'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/openapi/swagger/resources',

method: 'GET',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'apikey' => 'APIKEY'

}

result = RestClient.get 'https://TENANT_NAME.mambu.com/openapi/swagger/resources',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'apikey': 'APIKEY'

}

r = requests.get('https://TENANT_NAME.mambu.com/openapi/swagger/resources', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/openapi/swagger/resources");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty("apikey", "APIKEY");

con.setRequestMethod("GET");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"apikey": []string{"APIKEY"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("GET", "https://TENANT_NAME.mambu.com/openapi/swagger/resources", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Example response

[

{

"label": "Clients",

"hashValue": "Clients",

"index": 0,

"resourcePaths": [

{

"version": "v2",

"jsonPath": "openapi/resources/clients/v2"

}

]

},

{

"label": "Client Documents",

"hashValue": "Client_Documents",

"index": 1,

"resourcePaths": [

{

"version": "v2",

"jsonPath": "openapi/resources/clients_documents/v2"

}

]

},

{

"label": "Branches",

"hashValue": "Branches",

"index": 2,

"resourcePaths": [

{

"version": "v2",

"jsonPath": "openapi/resources/branches/v2"

}

]

},

{

"label": "Centres",

"hashValue": "Centres",

"index": 3,

"resourcePaths": [

{

"version": "v2",

"jsonPath": "openapi/resources/centres/v2"

}

]

},

{

"label": "Users",

"hashValue": "Users",

"index": 4,

"resourcePaths": [

{

"version": "v2",

"jsonPath": "openapi/resources/users/v2"

}

]

}

]

To retrieve either the basic OAS file or the enriched OAS file with custom field values for a specific API, you must first build the path for the resource.

To build the path for a resource you must retrieve the jsonPath value. This value is provided when you retrieve the list of all available APIs.

To retrieve the list of all available APIs you may use the

https://TENANT_NAME.mambu.com/api/openapi/resources OAS v3 endpoint.

The response returns an array of objects. Each object represents an API and includes its jsonPath value.

Next, to retrieve the OAS file for a specific API. See Retrieving OAS v3 Files) below.

Retrieving OAS v3 Files

Request samples

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/openapi/resources \

-H 'apikey: APIKEY'

Example response

{

"openapi" : "3.0.1",

"info" : {

"title" : "clients",

"version" : "v2"

},

"servers" : [ {

"url" : "http://localhost:8889/api"

}, {

"url" : "https://localhost:8889/api"

} ],

"security" : [ {

"basic" : [ ]

} ],

"tags" : [ {

"description" : "Allows you to get, create, update, or delete clients. Clients may have associated information such as their address, identification documents, or custom field values.",

"name" : "Clients"

} ]

}

Once you have followed the steps to retrieve the jsonPath value for a specific API, you can build the path to a specific resource.

To retrieve the specification file for a given API, join the base URL with the value of the relevant jsonPath.

Basic OAS file

The basic OAS file will not include any custom field values and you do not need to authenticate to access this endpoint.

The endpoint to retrieve the basic OAS file is:

https://TENANT_NAME.mambu.com/api/{jsonPath}

For example, to retrieve the basic OAS file for the Clients API you would use:

https://TENANT_NAME.mambu.com/api/openapi/resources/clients/v2

Enriched OAS file

The enriched OAS file will include any custom field values you have set up for your organisation at the time of generation. This endpoint requires authentication using either HTTP Basic Auth or an API key provided in an apikey header.

The endpoint to retrieve the enriched OAS file with custom field values is:

https://TENANT_NAME.mambu.com/api/{jsonPath}/complete

For example, to retrieve the enriched OAS file for the Clients API you would use:

https://TENANT_NAME.mambu.com/api/openapi/resources/clients/v2/complete

Both endpoints are available for both your production and sandbox environments. Replace TENANT_NAME with TENANT_NAME.sandbox to access API specifications for the sandbox environment, which is usually one version ahead of production. This gives you time to investigate new features and functionality before using it in production.

OAS v2 API Discovery

Request samples

Code samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/swagger/resources \

-H 'apikey: APIKEY'

GET https://TENANT_NAME.mambu.com/api/swagger/resources HTTP/1.1

Host: TENANT_NAME.mambu.com

apikey: APIKEY

var headers = {

'apikey':'APIKEY'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/swagger/resources',

method: 'GET',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'apikey' => 'APIKEY'

}

result = RestClient.get 'https://TENANT_NAME.mambu.com/api/swagger/resources',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'apikey': 'APIKEY'

}

r = requests.get('https://TENANT_NAME.mambu.com/api/swagger/resources', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/swagger/resources");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty("apikey", "APIKEY");

con.setRequestMethod("GET");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"apikey": []string{"APIKEY"},

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("GET", "https://TENANT_NAME.mambu.com/api/swagger/resources", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Example response

{

"items": [

{

"jsonPath": "json/clients_v2_swagger.json",

"label": "Clients",

"hashValue": "Clients",

"index": 0

},

{

"jsonPath": "json/clients_documents_v2_swagger.json",

"label": "Client Documents",

"hashValue": "Client_Documents",

"index": 1

},

{

"jsonPath": "json/branches_v2_swagger.json",

"label": "Branches",

"hashValue": "Branches",

"index": 2

},

{

"jsonPath": "json/centres_v2_swagger.json",

"label": "Centres",

"hashValue": "Centres",

"index": 3

},

...

{

"jsonPath": "json/configuration_iddocumenttemplates.yaml_v2_swagger.json",

"label": "Identification Document Templates Configuration",

"hashValue": "Identification_Document_Templates_Configuration",

"index": 64

},

{

"jsonPath": "json/configuration_loanrisklevels.yaml_v2_swagger.json",

"label": "Loan Risk Levels Configuration",

"hashValue": "Loan_Risk_Levels_Configuration",

"index": 65

},

{

"jsonPath": "json/currencies_v2_swagger.json",

"label": "Currencies",

"hashValue": "Currencies",

"index": 66

}

]

}

To retrieve either the basic OAS file or the enriched OAS file with custom field values for a specific API, you must first build the path for the resource.

To build the path for a resource you must retrieve the jsonPath value. This value is provided when you retrieve the list of all available APIs.

To retrieve the list of all available APIs you may use the https://TENANT_NAME.mambu.com/api/swagger/resources endpoint.

The response returns an array of objects. Each object represents an API and includes its jsonPath value.

Next, to retrieve the OAS file for a specific API. See Retrieving OAS v2 Files below.

Retrieving OAS v2 Files

Code Samples

# You can also use wget

curl -X GET https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file} \

-H 'apikey: APIKEY'

GET https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file} HTTP/1.1

Host: TENANT_NAME.mambu.com

apikey: APIKEY

var headers = {

'apikey':'APIKEY'

};

$.ajax({

url: 'https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}',

method: 'GET',

headers: headers,

success: function(data) {

console.log(JSON.stringify(data));

}

})

require 'rest-client'

require 'json'

headers = {

'apikey' => 'APIKEY'

}

result = RestClient.get 'https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}',

params: {

}, headers: headers

p JSON.parse(result)

import requests

headers = {

'apikey': 'APIKEY'

}

r = requests.get('https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}', params={

}, headers = headers)

print r.json()

URL obj = new URL("https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestProperty("apikey", "APIKEY");

con.setRequestMethod("GET");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

package main

import (

"bytes"

"net/http"

)

func main() {

headers := map[string][]string{

"apikey": []string{"APIKEY"}

}

data := bytes.NewBuffer([]byte{jsonReq})

req, err := http.NewRequest("GET", "https://TENANT_NAME.mambu.com/api/swagger/completejson/{OAS-file}", data)

req.Header = headers

client := &http.Client{}

resp, err := client.Do(req)

// ...

}

Example response

{

"swagger": "2.0",

"info": {

"version": "v2",

"title": "clients"

},

"host": "localhost:8889",

"basePath": "/api",

"tags": [

{

"name": "Clients",

"description": "Allows you to retrieve, create, update, or delete clients. Clients may have associated information such as their address, identification documents, or custom field values."

}

],

"schemes": [

"http",

"https"

],

"paths": {

...

},

"securityDefinitions": {

"basic": {

"description": "",

"type": "basic"

}

},

"definitions": {

...

}

}

Once you have followed the steps to retrieve the jsonPath value for a specific API, you can build the path to a specific resource.

To retrieve the specification file for a given API, join the base URL with the value of the relevant jsonPath.

Basic OAS file

The basic OAS file will not include any custom field values and you do not need to authenticate to access this endpoint.

The endpoint to retrieve the basic OAS file is:

https://TENANT_NAME.mambu.com/api/swagger/{jsonPath}

For example, to retrieve the basic OAS file for the Clients API you would use:

https://TENANT_NAME.mambu.com/api/swagger/json/clients_v2_swagger.json

Enriched OAS file

The enriched OAS file will include any custom field values you have set up for your organisation at the time of generation. This endpoint requires authentication using either HTTP Basic Auth or an API key provided in an apikey header.

The endpoint to retrieve the enriched OAS file with custom field values is:

https://TENANT_NAME.mambu.com/api/swagger/complete{jsonPath}

For example, to retrieve the enriched OAS file for the Clients API you would use:

https://TENANT_NAME.mambu.com/api/swagger/completejson/clients_v2_swagger.json

Both endpoints are available for both your production and sandbox environments. Replace TENANT_NAME with TENANT_NAME.sandbox to access API specifications for the sandbox environment, which is usually one version ahead of production. This gives you time to investigate new features and functionality before using it in production.

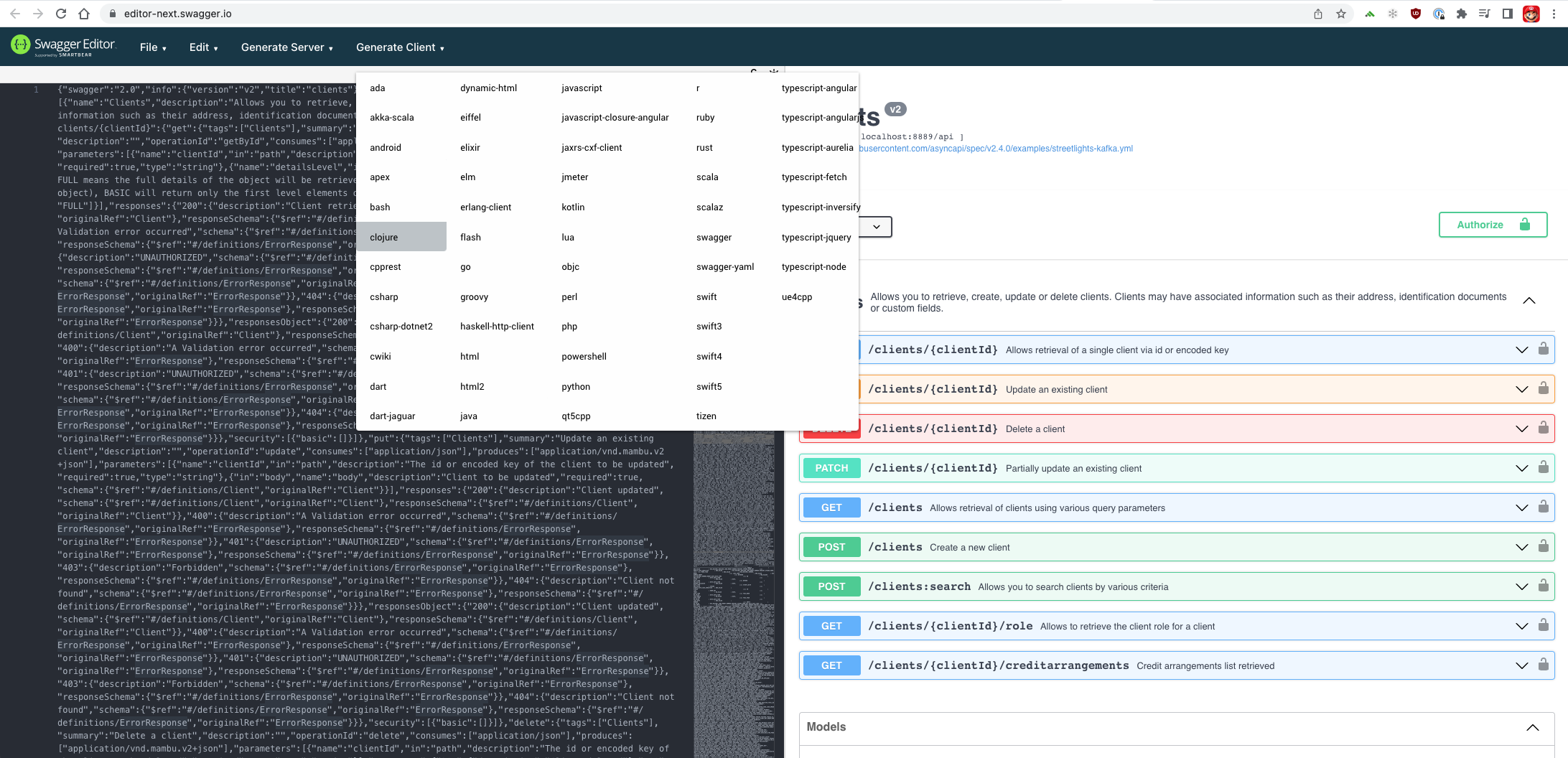

Generating SDKs from OAS

Once you have your OAS file you are free to use any number of tools to generate a client SDK in your preferred language, for example, the freely available and online Swagger Editor. By either importing the file or copying the specification into the editor window you will be able to see both navigable documentation and the option located at the top of the window to Generate Client.

Remember to edit the host field in your OAS file to reflect your Mambu domain before generating your SDK. For more information on your Mambu domain, see Base URLs.

Searching for Records

A basic search query for loans from a particular product type, sort by approval date

POST /loans:search

{

"filterCriteria": [

{

"field": "loanName",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "Agriculture Loan"

}

],

"sortingCriteria": {

"field": "approvedDate",

"order": "DESC"

}

}

A search for current accounts which are active and overdrawn from two different branches using compound filters, sort by overdraft balance

POST /deposits:search

{

"filterCriteria": [

{

"field": "accountState",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "ACTIVE"

},

{

"field": "accountType",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "CURRENT_ACCOUNT"

},

{

"field": "balances.overdraftAmount",

"operator": "MORE_THAN",

"value": 0

},

{

"field": "assignedBranchKey",

"operator": "in",

"values": [

"8a193c26722b51b701722d779e7122de",

"8a193c26722b51b701722d779e7122df"

]

}

],

"sortingCriteria": {

"field": "balances.overdraftAmount",

"order": "DESC"

}

}

Search functionality is provided for a number of entities through dedicated endpoints that can be identified by the :search suffix, for example to search for deposit accounts you can use the /deposits:search endpoint. Search endpoints accept a POST request that can include an object containing a filterCriteria array of objects and a sortingCriteria object in the request body.

The filterCriteria array of objects allows you to narrow your search using multiple fields to filter by. Every entity that supports search has a schema that provides the enumerated values available for the filter properties, for example, the schema for a deposit account search is DepositAccountFilterCriteria.

The sortingCriteria object allows you to specify according to which field and in what way you would like to sort the returned results. Every entity that supports search provides a schema with all the available fields you can sort by. For example, the schema for sorting the results of a deposit account search is DepositAccountSortingCriteria.

Apart from native fields that are enumerated in the relevant schemas that you can use in your filter criteria, you can also filter by custom fields. For more information, see Searching by custom fields.

API v2 also provides a couple of additional features that allow you to further customize and manage your search queries.

The pagination query parameters allow you to break up your search into smaller chunks, for more information, see Pagination and Optimising Searches.

Additionally you can perform cursor-based pagination which can significantly improve performance with large data sets. For more information, see cursor-based search pagination.

The detailsLevel query parameter allows you to specify the level of detail to include in the results. For more information, see Details Level and Optimising Searches.

Cursor-based search pagination

Cursor-based search pagination offers significantly better performance, particularly in large data sets, than offset-based search. This method uses a defined cursor, which represents the current position in the data set, and a limit to retrieve results. To start cursor pagination, the cursor: “_” query parameter needs to used in combination with limit. This is equivalent to starting the search from the first item in the data set.

After each API call using a cursor query parameter, a new header is returned in the response: Items-Next-Cursor. This value is the cursor to be used in the next cursor-based search API call. When Items-Next-Cursor is empty (an empty string), the search is over: there are no items left in the data set.

Cursor-based searching is supported for the following data types:

| Endpoint | Query example | Cursor field(s) |

|---|---|---|

| journal entries | /gljournalentries:search?limit=100&cursor=_ |

entryId |

| deposit accounts | /deposits:search?limit=1&cursor=_ |

lastModifiedDate and encodedKey |

| deposit transactions | /deposits/transactions:search?limit=1&cursor=_ |

transactionId |

| loan accounts | /loans:search?limit=1&cursor=_ |

lastModifiedDate and encodedKey |

| loan transactions | /loans/transactions:search?limit=3&cursor=_ |

transactionId |

The journal entries, deposit transactions, and loan transactions data types use an indexed auto-incrementing ID field as their cursor. While the cursor is indexed, performance issues could arise if the search query contains additional filters that use non-indexed columns. Deposit accounts and loan accounts use a compound field to define the cursor, and do not allow for further query filters.

When using cursor-based searching, some features of the search APIs are not supported:

- journal entries: at least one filter by

creationDateorbookingDateusing theBETWEENoperator should be present; on top of this, other filters can be added, for example, a filter byglAccountIdorglAccountName. - loan and deposit transactions: at least one filter by

creationDateorvalueDateusing theBETWEENoperator should be present; on top of this, other filters can be added, for example, a filter byparentAccountId. - Loan and deposit accounts: exactly one filter by the

lastModifiedDatefield using theBETWEENoperator is accepted. - No sort criteria can be specified; the items are always sorted by the cursor field.

paginationDetails=ONis not supported.- The first cursor-based search (using the

“_”as the cursor) will also compute the minimum and maximum cursor values. Therefore, this API call can take more time than the subsequent API calls, which will take roughly the same amount of time regardless of the cursor’s position in the data set. This is in contrast to offset-based searching, which takes increasingly more time as the offset value increases.

For more information on pagination in Mambu APIs, see pagination.

Cursor-based search pagination with application/vnd.mambu.v2+octetstream Accept header

Some APIs can handle conditions where the application/vnd.mambu.v2+octetstream Accept header is sent together with the cursor=_ parameter . This sends back an octet stream of all the data until the end of the cursor to a single file. The connection will only be closed if the client terminates it or all the data is retrieved from the database.

Searching by custom fields

Search for entries where the given custom field definition has the value

FALSE

{

"filterCriteria": [

{

"field": "_marketing_opt_in.investor_newsletter",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "FALSE"

}

]

}

Search for entries where the given custom field definition has one of the given values, sort by ID

{

"filterCriteria": [

{

"field": "_group_details.industry",

"operator": "IN",

"values": [

"agriculture",

"arboriculture"

]

}

],

"sortingCriteria": {

"field": "id",

"order": "ASC"

}

}

You can build your filter and search queries using the native fields enumerated in the relevant schemas, for more information, see Searching for Records. However, you can also use custom field definitions and their values in your filter and search queries for any entities that support custom field definitions. For more information, see Custom Fields in our User Guide.

To filter or sort using a custom field definition you must provide the custom field set ID and the custom field definition ID using dot nation, for example _custom_field_set_ID.custom_field_ID. You can see an example of the syntax to the right. The custom field set can belong to the same entity or to a parent entity.

Filter Operators

Equals

{

"field": "overdraftSettings.allowOverdraft",

"operator": "EQUALS",

"value": true

}

Equals (case sensitive)

{

"field": "name",

"operator": "EQUALS_CASE_SENSITIVE",

"value": "Daily Savings"

}

More than

{

"field": "balances.totalBalance",

"operator": "MORE_THAN",

"value": 500000.50

}

Less than

{

"field": "accruedAmounts.interestAccrued",

"operator": "LESS_THAN",

"value": 10000.10

}

Between

{

"field": "balances.feesDue",

"operator": "BETWEEN",

"value": 100,

"secondValue" : 500

}

On

{

"field": "approvedDate",

"operator": "ON",

"value": "2021-06-15"

}

After

{

"field": "lastModifiedDate",

"operator": "AFTER",

"value": "2022-04-20"

}

Before

{

"field": "creationDate",

"operator": "BEFORE",

"value": "2021-12-25"

}

Before inclusive

{

"field": "creationDate",

"operator": "BEFORE_INCLUSIVE",

"value": "2020-06-15"

}

Starts with

{

"field": "id",

"operator": "STARTS_WITH",

"value":"eban"

}

Starts with (case sensitive)

{

"field": "id",

"operator": "STARTS_WITH",

"value":"EBAN"

}

In

{

"field": "accountType",

"operator": "IN",

"values":[

"REGULAR_SAVINGS",

"CURRENT_ACCOUNT"

]

}

Today

{

"field": "approvedDate",

"operator": "TODAY"

}

This week

{

"field": "disbursementDetails.expectedDisbursementDate",

"operator": "THIS_WEEK"

}

This month

{

"field": "lastPaymentDate",

"operator": "THIS_MONTH"

}

This year

{

"field": "expectedMaturityDate",

"operator": "THIS_YEAR"

}

Last x days

{

"field": "firstRepaymentDate",

"operator": "LAST_DAYS",

"value": 12

}

Empty

{

"field": "overdraftRiskLevelKey",

"operator": "EMPTY"

}

Not empty

{

"field": "lastSetToArrearsDate",

"operator": "NOT_EMPTY"

}

The table below contains available operators as well as the types of field they are compatible with and the number of values they support.

| Operator | Affected values | Available for |

|---|---|---|

| EQUALS | ONE_VALUE | BIG_DECIMAL, BOOLEAN, LONG, MONEY, NUMBER, PERCENT, STRING, ENUM, KEY |

| EQUALS_CASE_SENSITIVE | ONE_VALUE | STRING, BOOLEAN, DATE, NUMBER, ENUM, KEY |

| MORE_THAN | ONE_VALUE | BIG_DECIMAL, NUMBER, MONEY |

| LESS_THAN | ONE_VALUE | BIG_DECIMAL, NUMBER, MONEY |

| BETWEEN | TWO_VALUES | BIG_DECIMAL, NUMBER, MONEY, DATE, DATE_TIME |

| ON | ONE_VALUE | DATE, DATE_TIME |

| AFTER | ONE_VALUE | DATE, DATE_TIME |

| BEFORE | ONE_VALUE | DATE, DATE_TIME |

| BEFORE_INCLUSIVE | ONE_VALUE | DATE, DATE_TIME |

| STARTS_WITH | ONE_VALUE | STRING |

| STARTS_WITH_CASE_SENSITIVE | ONE_VALUE | STRING |

| IN | LIST | ENUM,KEY |

| TODAY | NO_VALUE | DATE, DATE_TIME |

| THIS_WEEK | NO_VALUE | DATE, DATE_TIME |

| THIS_MONTH | NO_VALUE | DATE, DATE_TIME |

| THIS_YEAR | NO_VALUE | DATE, DATE_TIME |

| LAST_DAYS | ONE_VALUE | NUMBER |

| EMPTY | NO_VALUE | BIG_DECIMAL, LONG, MONEY, NUMBER, PERCENT, STRING, ENUM, KEY, DATE, DATE_TIME |

| NOT_EMPTY | NO_VALUE | BIG_DECIMAL, LONG, MONEY, NUMBER, PERCENT, STRING, ENUM, KEY, DATE, DATE_TIME |

Considerations for specific field types

-

The

DATE_TIMEoperator: When using aDATE_TIMEoperator, you can opt to provide the time offset for your timezone or use UTC. For example, searching for records that were created after aDATE_TIMEof2022-04-25T13:00:00+02:00should give you the same results as using the UTC equivalent date time of2022-04-25T11:00:00+00:00. When using just the date, the local time zone will always be used. -

The

BEFOREoperator: When using aBEFOREoperator for dates, the date provided will not be included. If you wish to include the date provided, use theBEFORE_INCLUSIVEoperator. -

The

BETWEENoperator: When using theBETWEENoperator with two dates, the start date (valueparameter) will be inclusive while the end date (secondValueparameter) will be exclusive. This means that if you wish to include a record in your results that, for example, took place at 12:00pm on the 22nd July 2023, you should use22023-07-22T12:01:00as your end timestamp. -

The

EQUALSandEQUALS_CASE_SENSITIVEoperators: If usingEQUALSas the operator, true or false values are cast to boolean sotrue,"true", and"TRUE"should all yield the same results. This includes checkbox type custom field definitions where the value is returned as an uppercase string of either"TRUE"or"FALSE". This is not the case when usingEQUALS_CASE_SENSITIVEas the operator, so, if searching based on a checkbox type custom field definition with theEQUALS_CASE_SENSITIVEoperator, you will need to provide the value as an uppercase string.

Optimising Searches

There are a few ways to make sure that your searches are optimised for performance. This becomes increasingly necessary the more records there are in the system.

- Make use of the

EQUALS_CASE_SENSITIVEoperator: We recommend that you do not use the EQUALS operator, as it causes performance issues with larger data sets. Using the EQUALS_CASE_SENSITIVE operator can provide much faster results. The EQUALS operator will transform field values to lowercase before testing against the filter criteria, leading to performance issues. - Avoid broad searches: If your searches are returning a lot of results (more than 100k), consider adding narrower filter criteria and avoid pagination with large

offsetvalues. If possible, update the filter values instead of paginating by offset. The filter value can be updated based on data form previous searches or by splitting a large interval into smaller equal parts. For example, start by searching for journal entries withcreationDate AFTER 2023-07-22T00:00:00,limit=100and sorted bycreationDatein ascending order. Assuming the last journal entry in the result was created on2023-07-22T01:24:35continue by searching for journal entries withcreationDate AFTER 2023-07-22T01:24:35. Alternatively instead of searching forcreationDate ON 2023-07-22orcreationDate BETWEEN 2023-07-22T00:00:00 AND 2023-07-23T00:00:00and paginating through the results, make more queries with smaller intervals such ascreationDate BETWEEN 2023-07-22T00:00:00 AND 2023-07-22T01:00:00..creationDate BETWEEN 2023-07-22T23:00:00 AND 2023-07-23T00:00:00. - Use indexed fields for search: For a given entity, certain fields will be indexed in the database. Searching using these fields can dramatically speed up performance. Have at least one highly selective filter based on the indexed columns, do not rely on filter combinations to reduce the number of records returned by the query. If you have access to a database clone, you can use a GUI to list all indexed fields or an SQL query such as:

SELECT DISTINCT TABLE_NAME, INDEX_NAME, COLUMN_NAME FROM INFORMATION_SCHEMA.STATISTICS. - Prefer sorting by a filtered field: Unless the number of records matching the specified filter criteria is very small (~10k) avoid sorting by a different field than the most constraining filter criteria. For example, if you are filtering by

lastModifiedDatedo not sort bycreationDate. When using multiple filter criteria, you should only sort by the field of the most selective filter. - Avoid large offsets for pagination: Use a low value for the query offset parameter. Consider adding a supplementary filter or change the value for existing filters to have a lower total number of results rather than have a high offset value. Larger offsets increse response latency because 'skipping records' still requires that the application identifies and sorts the skipped records. For more information, see Pagination.

- Make use of the limit parameter for single record searches: If you are making a search for something that should only return exactly one result, for example, an account by ID or encoded key, setting a

limitof1will be more performant than making the same search query with no limit provided. For more information, see Pagination. - Do not request full details if they are not required: In most cases, we recommend keeping the default value for the

detailsLevelquery parameter, which isBASICand then using the results to make subsequent requests to aGETendpoint using an encoded key or ID. For more information, see Details Level . - Time box queries: If you are only interested in results occurring over a given time frame, for example, transactions for a given month or quarter, you can use the

BEFOREandAFTERorBETWEENoperators to avoid making searches over the entire database. - Do not include null values if they are not needed: If you do not want to search for a field using a null value, do not include null values in the payload of the search request.

Time Zone Offsets

Here is how we handle time zone offsets in API v2 calls:

- We use the following standard date format: ISO_8601_FORMAT_DATE_TIME = "YYYY-MM-DD'T'hh:mm:ss±hh:mm".

- We calculate the offset for the date sent by the client, at that moment in time, taking into consideration the tenant’s time zone. For example: "−05:00" for New York on standard time (UTC-05:00), "−04:00" for New York on daylight saving time (UTC-04:00).

- We compare the offset value sent by the client with the offset value calculated by us. If they don’t match an exception is thrown which informs the client about the correct offset. See example.

Example JSON body showing an invalid date offset request

{

"errors": [

{

"errorCode": 4,

"errorSource": "Invalid date offset for value 2021-03-09T13:37:50 org offset is +02:00",

"errorReason": "INVALID_PARAMETERS"

}

]

}

Example

Each Mambu tenant has one time zone. Let’s take for example tenants in the East European time zone (UTC+02:00).

| Date and time of request | Error message or What is saved in the database |

|---|---|

| 2021-03-09T13:37:50 | “Invalid date offset for value 2021-03-09T13:37:50 org offset is +02:00” |

| 2021-03-09T13:37:50+03:00 | “Invalid date offset for value 2021-03-09T13:37:50 org offset is +02:00” |

| 2021-03-09T13:37:50+02:00 | 2021-03-09 13:37:50 |

Using Custom Fields

Overview

Standard custom field set with custom field values

{

...

"_customFieldSet": {

"customFieldDefinitionId1": "value",

"customFieldDefinitionId2": "value",

"customFieldDefinitionId3": "value"

}

...

}

Grouped custom field set with custom field values

{

...

"_customFieldSet": [

{

"_index": "0",

"customFieldDefinitionId1": "value",

"customFieldDefinitionId2": "value",

"customFieldDefinitionId3": "value"

},

{

"_index": "1",

"customFieldDefinitionId1": "value",

"customFieldDefinitionId2": "value",

"customFieldDefinitionId3": "value"

}

]

...

}

Custom fields are fields you may create for several entities that allow you to capture additional relevant information and they are grouped together in custom field sets.